VoP user group: looking back at the first workshop

At LUXHUB, we’ve launched a Verification of Payee solution, called Payee Verification Platform, which is destined to Payment Service Providers all over the EU, in the context of the Instant Payments Regulation. After onboarding our first customers, we’re now organizing a series of workshop for our VoP user group members, composed of dozens of payments and compliance experts.

With the obligation entering into application in less than one year, we’ve brought together several experts for a first session at the end of October 2024. Animated by Ramzi Dziri, Head of Product and payments expert, the workshop first focused on version 1 of VoP Scheme Rulebook, recently published by the European Payments Council (EPC).

EPC VoP Scheme Rulebook 1.0 digest

| General aspects of the scheme | Adherence for PSPs only (could be done through an agent) |

| Guide to the VOP Scheme Adherence Process to be defined in 2025 | |

| VOP Scheme Inter-PSP API Specifications document not available yet | |

| Scheme applies to SEPA scheme countries (27 EU + 3 EEA + 6 non-EEA) | |

| VoP service features | No batch VOP requests allowed (won’t impact PVP participants) |

| Possibility to offer additional optional services in parallel to VoP (to be developed) | |

| Different delays for VoP response, going from 3 to 5 seconds (PVP aims at a much lower target, less than 0.5 second) | |

| Need to support sending/receiving additional information to identify the payment counterparty in case of collecting account, PSP sub-accounts, virtual IBANs and other similar cases | |

| VoP matching logic | No big changes in the rules from the initial proposal of February 2024 aside: - explicit introduction of the 'verification check not possible' as a fourth answer, - acknowledgment that recommendations/scenarios provided by EPC are not exhaustive ‘rules’ but ‘guidelines’ |

| VoP matching flow | More specific details on the EDS which lists participants in the scheme, provides routing data to send the request and details identifiers supported by a PSP |

| Introduction of the concept of local copy of the EDS | |

| Requirement for PSPs to update account holders' terms and conditions (provision & user of services related to the scheme, information regarding matching scenarios and implications, etc.) |

Guiding principles & rules for PVP matching logic

To ensure consistency across providers and Payment Service Providers, the Payee Verification Platform logic follows the EPC guidelines deciphered above. The matching logic concretely implements these guidelines (distance algorithm, affixes and nickname lists, etc.) and complements them following a general flow: NAME PRE-PROCESSING → STRICT RULES MATCH → TOKENIZATION → FUZZY MATCH → FINAL MATCHING RESPONSE

The matching logic will continue to be incrementally tweaked in the coming months, notably with the addition of new “strict” rules, the adjustment of certain variables (e.g. threshold of matching) and the enrichment of the various reference lists (affixes, nicknames in additional languages).

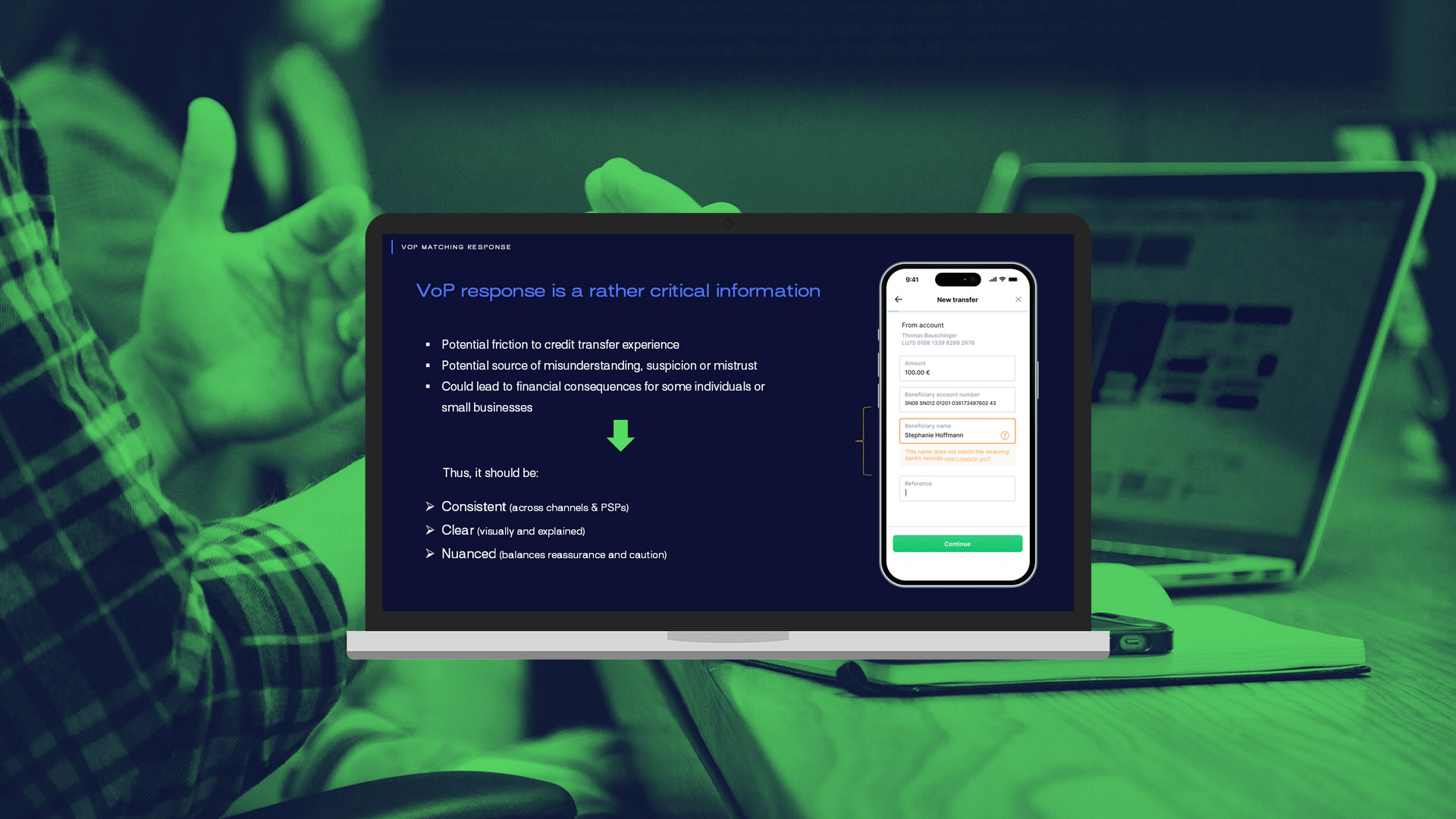

Finally, regarding the messages that PSPs communicate to end-user based on the VoP matching outcome, Ramzi added: “VoP response is a rather critical information. It can cause potential friction to the credit transfer experience or could even lead to financial consequences for some individuals or small businesses”. In this respect, messaging should be CONSISTENT, CLEAR and also NUANCED.

Interested in joining the VoP user group? Get in touch with the team.