VOP User Group #2: EPC clarifications and solution updates

After a first workshop held last October, existing and new members of the LUXHUB VOP user group met again in January 2025. The focus of this second session was on the latest updates of the EPC VOP Scheme, with the benefits of the Payee Verification Payee solution also being discussed.

EPC VOP Scheme

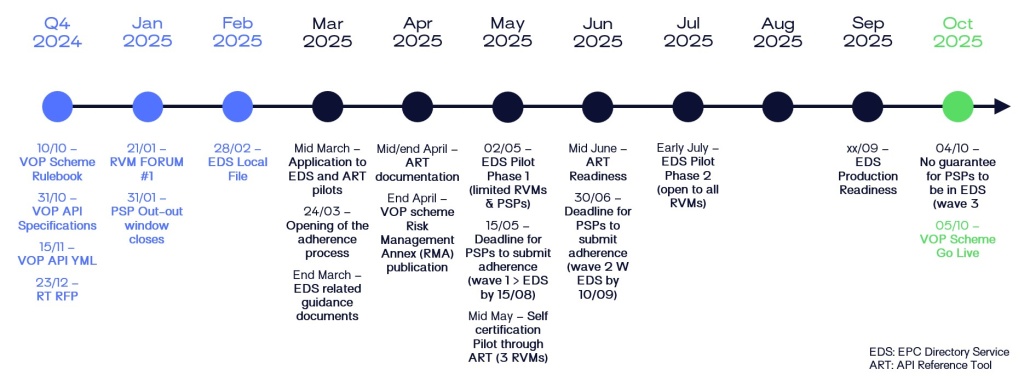

Additional (key) information has been published by the European Payments Council since the first session was held. Additional documentation and updates will be shared in the next weeks and months to help Payment Service Providers efficiently prepare for the October 9th deadline. The following timeline (updated on March 12th) shows which documents are expected, and when:

Recently, the EPC published the list of RVMs (Routing and/or Verification Mechanisms) compliant with the VOP Scheme – LUXHUB is featured in it – and also clarified the different roles.

Moreover, the (new) status of a Qualified RVM (QRVM) was introduced. To become a Q-RVM, an agreement with the EPC will be required. It enables access to retrieve EDS data on behalf of PSPs (GUI and/or API) and update it (API). It simplifies the VOP API certification process since only the Q-RVM would be required to undergo it (through the EPC’s API Test Toolbox for the VOP scheme).

The Payee Verification Solution

PSPs are free to choose the reach including countries that are either not in Instant Payments Regulation scope, or will be but only on a later stage. The VOP obligation will in fact first concern 20 EU countries using the € as currency. In July 2027, 7 additional EU countries out of the Eurozone will be concerned. 4 other countries that are part of the SEPA area could also potentially be available (and added). These connections to the various providers will be done through the EPC Scheme or partner RVMs. And through other partners, non-SEPA countries could also be added.

The Payee Verification Platform is composed of two different VOP interfaces: one for basic compliance and one for a richer VOP service. Available for clients and Partner RVMs, the “LH Unified Access API” will differ from the classic EPC standard API and will contain a more flexible matching logic to increase matches, detailed “verification not possible” responses, bulk VOP checks, feedback on PSU decision, etc.

The LUXHUB Team is also currently working on challenging name matching cases. This concerns administrations and other common public payees, when the standard matching logic might not be sufficient to achieve satisfying matching outcomes. One can also think of independents (single-person legal entity name vs. person name), the healthcare sector (with doctors and health service providers vs. legal entities owning the bank account), as well as legal name changes (corporates that changed their trade and/or legal name after an acquisition, a rebranding, etc.). As underlined by Ramzi Dziri, Head of Product @ LUXHUB, “it is important for PSPs to identify cases that might require a specific logic and collect examples”.

Other implementation considerations

The session ended with the members of the user group discussing specific matching scenarios (for instance, transfers to omnibus accounts, transfers for an account with multiple holders, etc.) and potential challenging matching scenarios (and especially collected e-commerce payments involving an acceptor/collecting PSP, or transfers towards ‘known’ payees available in a whitelist).

The LUXHUB Head of Product then focused on recurring payments, and the clarification brought lately which highlights that “checks are are only required at initiation, before the initial standing order’s authorization”.

He then shared more information on the ONE Check solution which could be offered by LUXHUB as part of its Payee Verification Platform, on top of its Unified Access and Service Provision services. More information will be shared soon by the LUXHUB team on the availability of this future solution.