VOP: LUXHUB is now registered as EPC VOP scheme-compliant RVM

The initial list of RVMs (Routing and/or Verification Mechanisms) compliant with the EPC Verification of Payee Scheme was recently published by the European Payments Council. LUXHUB, via its Payee Verification Platform, answered to the Call for Interest and is now listed on the EPC’s dedicated web page featuring RVMs compliant with the VOP Scheme. LUXHUB – also leveraging its Open Banking and connectivity expertise – is therefore more equipped than ever to support Payment Service Providers (PSPs) in their VOP project.

The role of RVMs

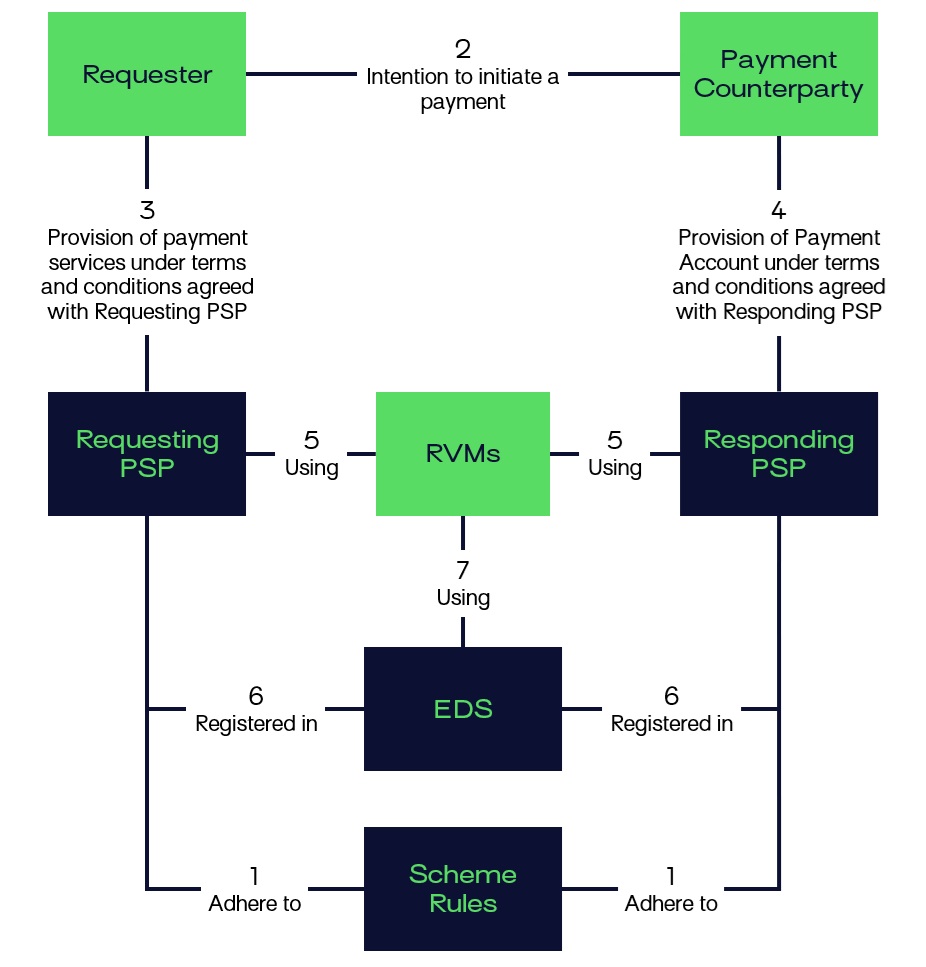

The concept of Routing and/or Verification Mechanisms was first introduced in the EPC VOP Scheme Rulebook. As explained therein, “an RVM provides Participants with a point of entry to be connected, directly or indirectly (via another RVM), with other Participants”.

The following schema depicts the central role of RVMs in the VOP process:

Concretely, on the requesting side, the RVMs will:

- Receive VOP Requests from Requesting PSPs who participate in the relevant RVM and forward the requests in full to the Responding PSPs, ensuring that all data submitted by the Requester and the Requesting PSP reaches the Responding PSPs,

- Receive VOP Responses from the Responding PSPs and forward these responses in full and without alteration to the Requesting PSPs who participate in the relevant RVM.

On the responding side, the RVMs, as Routing Mechanisms will:

- Receive VOP Requests from the Requesting PSP and forward the requests in full to the Responding PSPs who participate in the relevant RVM,

- Forward VOP Responses from the Responding PSPs who participate in the relevant RVM in full and without alteration to the Requesting PSPs,

- Receive a delegation of the PSPs they are offering their services to, enabling the RVMs to manage the routing data for these PSPs in the EPC Directory Service (EDS).

On the responding sides, RVMS that are “Verification Mechanisms will:

- Conduct the VOP actions on behalf of the Responding PSP and subject to an agreement between the RVM and the Responding PSP concerned.

- Handle the logic of payee details (names and/or identifiers) matching to generate a matching result.

Moreover, RVMs will have to provide any required risk management procedures and other related services. Also, the scheme allows RVMs to offer/monetize additional features or even services on top of VOP, on a contractual basis with their clients (PSUs).

LUXHUB’s Payee Verification Platform: a Routing AND Verification Mechanism

When the first hints of the Instant Payments Regulation were released, LUXHUB started investigating the possibility of developing a VOP solution destined to PSPs, leveraging its mutualization and Open Banking expertise as well as its API knowledge.

The Payee Verification Platform was announced back in July 2023, and was polished in the months that followed the entry into force of IPR in April 2024. So far, several major banks in Luxembourg have already selected the platform as their IPR-compliant VOP service in order to meet the regulatory requirement by October 9th, 2025. Following the publication of the EPC VOP Scheme Rulebook, LUXHUB expressed its interest in participating as RVM in the scheme, and is now listed as an “RVM compliant with the EPC Verification of Payee Scheme”. The LUXHUB-powered solution is actually a Routing AND Verification Mechanism, and can therefore perform the routing-related actions as well as the verification-related ones on behalf of the PSPs.

As highlighted by Claude Meurisse, CEO of LUXHUB, “As a compliance and Open Banking expert, it was only logical for LUXHUB to dive into IPR with the ambition to offer a robust solution to PSPs, which would leverage our API expertise. The LUXHUB Payee Verification Platform was recently recognized through the REGTECH100 list, highlighting the efficiency of the solution, as well as the necessity for PSPs to tackle this strategic project as the deadline is rapidly approaching.”