The State of AI in financial services

Tech giant Nvidia recently published its “State of AI in FS 2022 Trends” report, focusing, as the name indicates, on the use of Artificial Intelligence methods/tools in the financial services industry. As explained in the first lines of the report, “AI-enabled innovation is now mission critical for organizations in the financial services industry”.

In the current digital environment, traditional banks, Fintechs, BigTechs and even some retail companies are competing for consumers and their financial data. The report highlights: “this is compounded by highly innovative digital experiences being deployed across industries, which continue to shift consumer expectations”.

Financial services companies should therefore enhance the level of personalization, data security, customer service, pricing, and more in the creation and delivery of financial products or expect to lose market share to those who do. By applying AI, Machine Learning and Deep Learning methods and leveraging innovative tools, financial services companies have the ability to accelerate revenues, create operational efficiencies, and enhance customer experiences.

According to the report, “AI-enabled applications have moved from the innovation lab to being the nucleus of the new AI-led financial services enterprise”. They are powering banks, insurers, Fintechs and others to outperform competitors, increase customer lifetime value and increase market share.

The key takeaways of the report

Which tools are the most popular across the sectors of financial services?

- More than 75% of companies utilize at least one of the core accelerated computing use cases of high-performance computing (HPC), machine learning, and deep learning.

- Capital Market firms are the most prevalent users of Deep Learning tools, at 58%.

- Retail Banks also plebiscite Machine Learning, at around 60%.

- 80% of Fintechs, with the enterprise AI capabilities available from the cloud but may lack the scale of data needed to enable many deep learning use cases, are leveraging machine learning.

The benefits of AI in Financial Services:

- 43% of respondents stated that Artificial Intelligence is yielding more accurate models.

- According to 38% of respondents, AI creates competitive advantages.

- 29% explained that it creates operational efficiencies.

- Moreover, 28% of respondents stated that Artificial Intelligence AI methods help improve customer experiences.

The report highlights that “companies are experiencing significant financial benefit from enabling AI across the enterprise. Over 30% of respondents stated that AI increases annual revenues by more than 10%, while over a quarter stated that AI is reducing annual costs by more than 10%”.

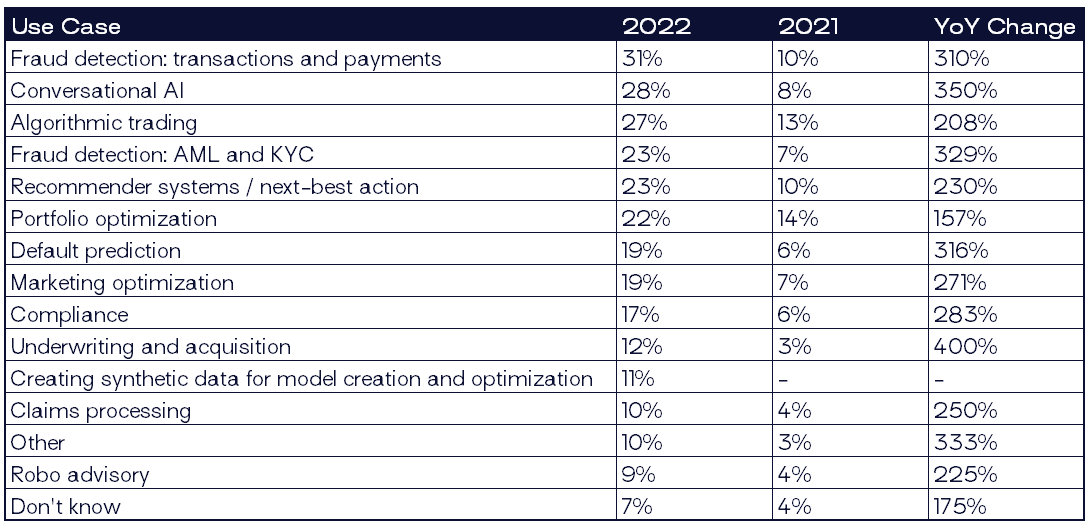

The most invested in use-cases:

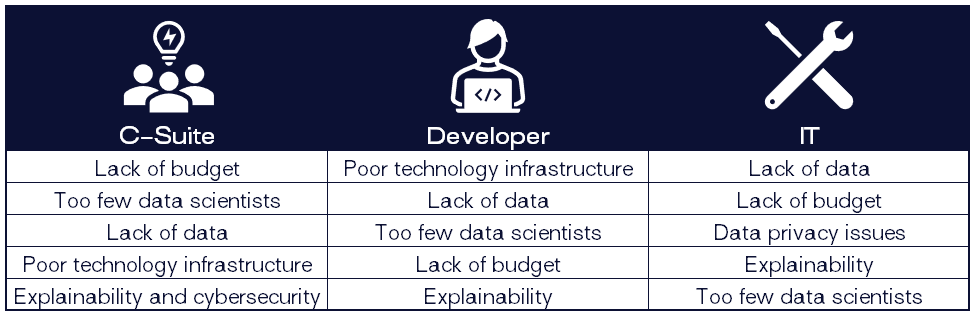

The biggest challenges in achieving the company’s AI goals (top 5, in rank order):

The report is available HERE.

A federated learning model, developed in Luxembourg

LUXHUB, the Open Finance pioneer located in Luxembourg, recently announced its partnership with University of Luxembourg’s Interdisciplinary Centre for Security, Reliability and Trust (SnT), to develop a robust Federated Learning model and therefore to apply innovative AI methods to the financial services.

As explained by Claude Meurisse, COO of LUXHUB:

By opting for such a model, we are making sure data never leaves the premises of the participating banks and Fintechs, and therefore security and confidentiality are ensured.

The experts are already working on key and concrete use-cases that will benefit the entire financial services industry, focusing notably on transaction categorization, fraud detection and much more.