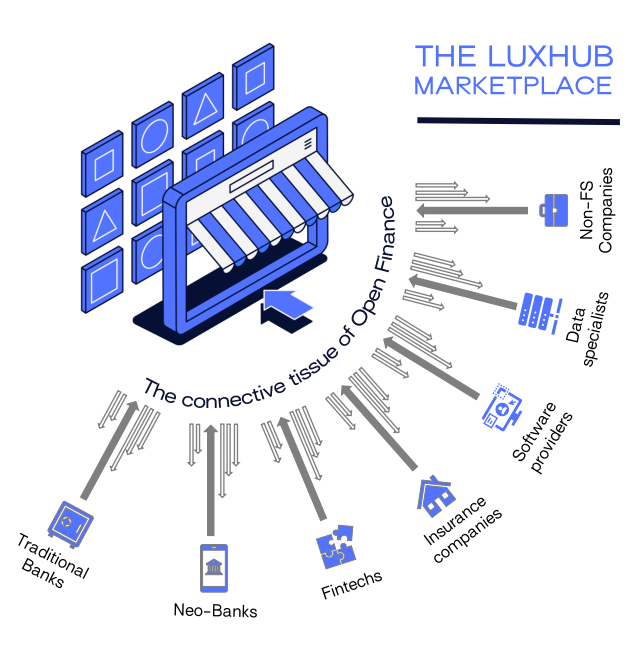

The Marketplace: a trusted platform benefiting all stakeholders

Radu Popa, Chief Technology Officer at LUXHUB, participated in the Paris edition of apidays, which took place from 7th to 9th December and gathered hundreds of tech experts and API enthusiasts to discuss the latest trends, as well as their current product offerings and innovative visions.

The Open Banking phenomenon

Radu’s speech was entitled “The connective tissue to Open Finance, A mutual platform to accelerate and optimize the future of finance”. The CTO first shared key Open Banking figures:

- As of 2020, 24.7 million individuals worldwide used open banking services – a number that is forecast to reach 132.2 million by 2024

- Europe counted approximately 12.2 million open banking users – this figure is expected to reach 63.8 million by 2024 (50% of total users)

- By December 2022, the total number of monthly API calls across EEA & UK is expected to reach 7.1bn

He added: “Globally, market and regulatory-driven API initiatives push API relevance and accelerate the opening-up of data in the financial sector. API business models enable banks and Fintechs to leverage new digital opportunities. Also, extensive API offerings of leading banks and Fintechs indicate a proactive approach”. In other words, Open Banking is getting strong traction from traditional players and newcomers, whether these initiatives are pushed by regulation or by the industry itself – in Switzerland for instance, it is being developed by our partners SIX –, with new services and offerings being generated.

Also, one must not forget about the end-users – individual or corporate users – who will eventually benefit from better and more advanced services.

Moreover, the global phenomenon is already evolving and moving towards Open Finance, with the incremental growth of a wider ecosystem, composed of API providers and consumers (either traditional financial institutions or Fintechs), hubs (platforms, technical service providers, API aggregators, etc.), and, of course, end-users. “Nowadays, we hear about ‘Open Anything’, which initiatives developed in the wealth management industry, in the energy sector, etc.,” added Radu.

The good, the bad… and the missing link

The Open Banking trend started with a legal framework – PSD2 in Europe – which is still extending and is getting more traction. As a matter of fact, market initiatives are now clearly expanding beyond compliance, trying to grasp the numerous opportunities offered by Open Banking/Finance, with more and more sophisticated products entering the market. Moreover, the number of “transactions” on Open Finance rails is increasing together with end user adoption, and last but not least, the lines between consumers and providers are blurring, with, for instance, banks consuming competitor PSD2 APIs. According to the CTO:

products are more and more sophisticated, some are even becoming commodities, and are therefore opening the way for new services to be built on top of it.

“Yet, we are still noticing a quite heavy fragmentation due to non-harmonized and non-standard approaches,” comments Radu Popa, “plus, there is a lack of engagement between participants, as a good number of service providers stuck into compliance assurance and not seeing value in opening up other type of services”.

On the tech perspective, Open Banking experts notice that traditional players are increasingly adopting API-based approaches, which notably help them expose the services they already have in order to generate new sources of revenue. “Several providers also have their own developer portals with their own documentation. But new standards still need to be defined and adopted,” underlined Radu Popa. And as explained earlier, the ecosystem is growing outside of the traditional banking/financial industry scope, with a focus on data notably, and the overall mission to provide end-users with trust, as well as with a strong user journey, breaking down the hurdles and barriers they are still facing today.

Filling the gap: the connective tissue between all Open Finance actors

“Most Open Finance players are currently facing similar challenges and also sharing common goals,” explained Radu Popa. To effectively enter the API Economy and/or take full advantage of it, they need to rely on a robust and trusted infrastructure/platform, which provides them with:

- A set of rules for admission criteria and certification program

- Standardized access control and user journey

- Well-defined business models

- Assured governance and mediation

- Level playing field for all participants

- Guaranteed quality of offerings for partners

- Trust for end users

The Marketplace brings participants together in a self-regulated framework, where they can find partners for their business initiatives – while providing them all the “behind the scenes” services they need, so they can concentrate on their business and offerings

Radu Popa, CTO, LUXHUB

This single platform enables the exchange of services and expertise – and create new revenue streams. It consists in a full-cycle, technical platform where all sector actors can promote their products and services to others and/or subscribe and integrate the products and services of others. It also provides a consistent and high standard experience for all users – both business and technical, provider and consumer.

“The LUXHUB Marketplace, with its 360-degree and full-cycle services, catalyzes the organic evolution of the sector, with increased adoption and sophistication. Moreover, it removes the barriers to entry, enhancing and accelerating value, opening up new revenue streams,” highlighted the CTO, who concluded: “it brings consumers and providers together and ensures a level playing field, laying the common playground for innovation!”

Watch the replay