“The Global State of Open Banking and Open Finance” Report – Part 3

This article is based on the University of Cambridge Report “The Global State of Open Banking and Open Finance”. Previously we provided a clear definition of Open Banking and Open Finance, which was followed by an explanation of the type of governance (regulatory or market driven) that exist and what do they imply. In this final part, we focus on the adoption of Open Banking and Open Finance as well as their impact across various markets.

Understanding Adoption and Impact

Trends in Global Adoption

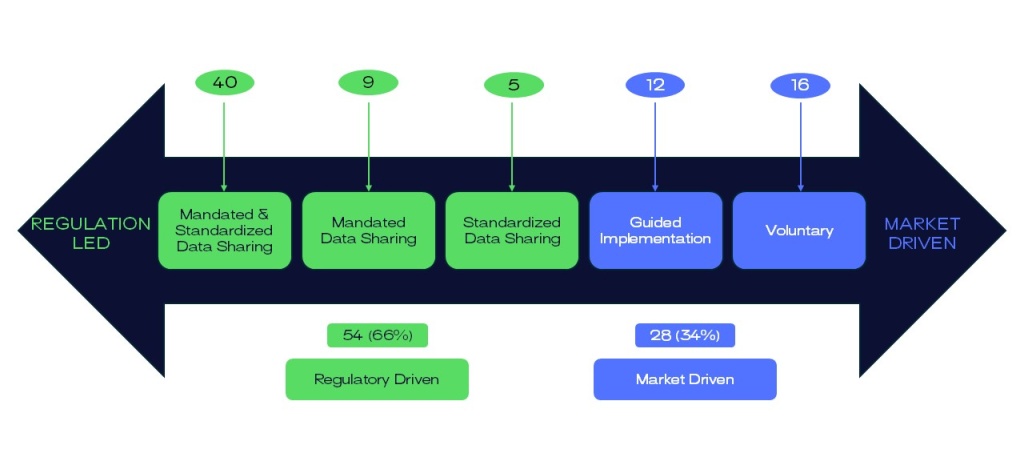

Most jurisdictions have implemented a regulation-led approach, with 54 jurisdictions taking this path, while 28 jurisdictions have opted for a market-driven approach.

Below is the breakdown of how many archetypes have been adopted depending on each approach.

Source: Cambridge Centre for Alternative Finance (CCAF)

Important notice: While most jurisdictions opted for the “Mandated & Standardized Data Sharing” approach, this finding is somewhat skewed due to the inclusion of the 27 jurisdictions in the EU, which was later treated as a single jurisdiction.

Trends in Regional Adoption

- Middle East and North Africa (MENA): Mostly Mandated & Standardized Data Sharing” approach

- Europe and Central Asia: Mostly regulation-lead – Mandated & Standardized Data Sharing” approach

- Sub-Saharan Africa (SSA): Market-driven approach (except for Nigeria)

- Latin America and the Caribbean (LAC): Vary a lot between each other because of political landscape.

- Asia Pacific (APAC): Mostly market-driven approach (except for Australia)

- North America: Canada = “Mandated & Standardized” – US = Mandated (still at the point of replacing screen scraping with APIs)

Disparities in approaches may be strongly influenced by the political landscape and the prioritization of Open Banking and Open Finance on political agendas.

Trends in Regulatory Authorities

Among the 54 regulation-led jurisdictions, it is noteworthy that 32 (or 59%) are led by central banks, while 19 (or 35%) are guided by financial services authorities. Furthermore, implementation in one jurisdiction is overseen by a government ministry, in another by a government agency, and in a different jurisdiction by a securities commission.

This diverse regulatory landscape brings to light an important correlation between Open Banking/Open Finance and the type of authority leading the initiative.

While this specific situation may not apply universally across jurisdictions, it underscores the importance of the regulatory authority and its powers in driving the success of Open Finance initiatives. This can be said of Brazil that is well advanced in Open Banking but not Open Insurance because of the entity in charge seems to have more limited influence.

Trends in Status

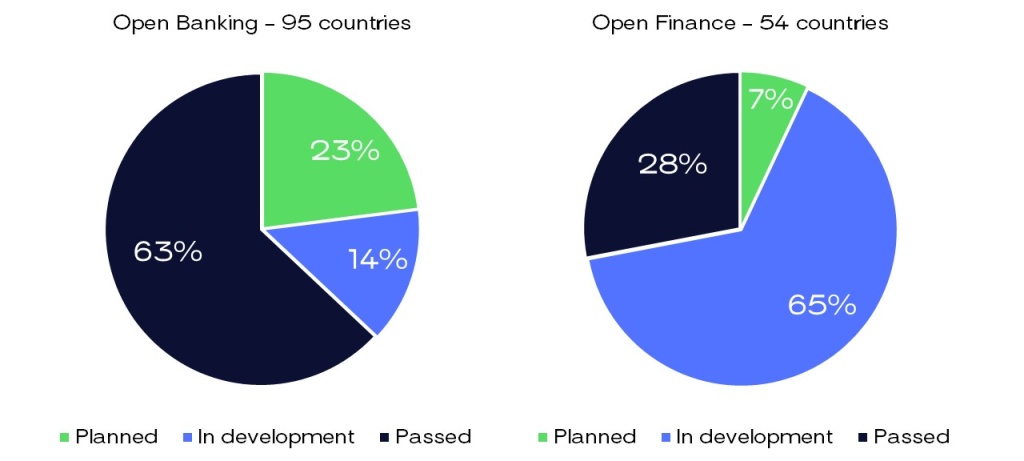

It’s important to note that although 82 jurisdictions have been identified as having adopted an Open Banking or Open Finance approach, a total of 95 jurisdictions were identified where Open Banking legislation, regulation or ‘guidance’ in market driven countries, is at various stages of development.

Each stage of development has been categorized into three parts:

- Passed: Open Banking / Open Finance legislation passed, or guidance issued by the relevant government authority.

- In Development: Legislation or guidance concerning Open Banking / Open Finance that is currently being formulated and has not yet been finalized or issued (e.g., circular issued, draft proposals, etc.).

- Planned: Open Banking / Open Finance initiative is under consideration or intended for development by relevant authorities, though formal actions or announcements may not have been made yet.

Source: CCAF

- Open Banking: 60 jurisdictions already passed legislation (49 regulation-led – 11 market-led)

- Open Finance: 37 jurisdictions in development stage + 41 jurisdictions adopted or planning Open Banking frameworks.

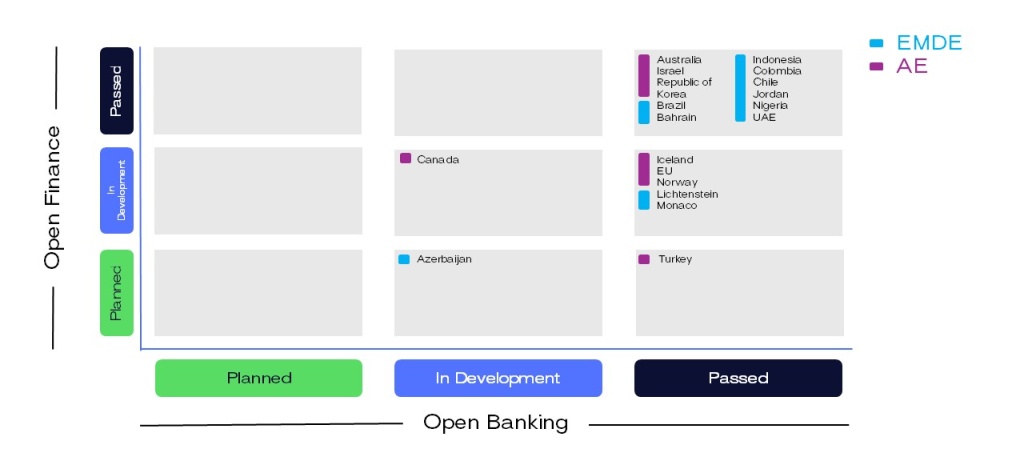

Among the 60 jurisdictions that have passed Open Banking legislation, only 16 have also passed Open Finance legislation (62% of them are EMDEs – Emerging Market and Developing Economies).

Source: CCAF

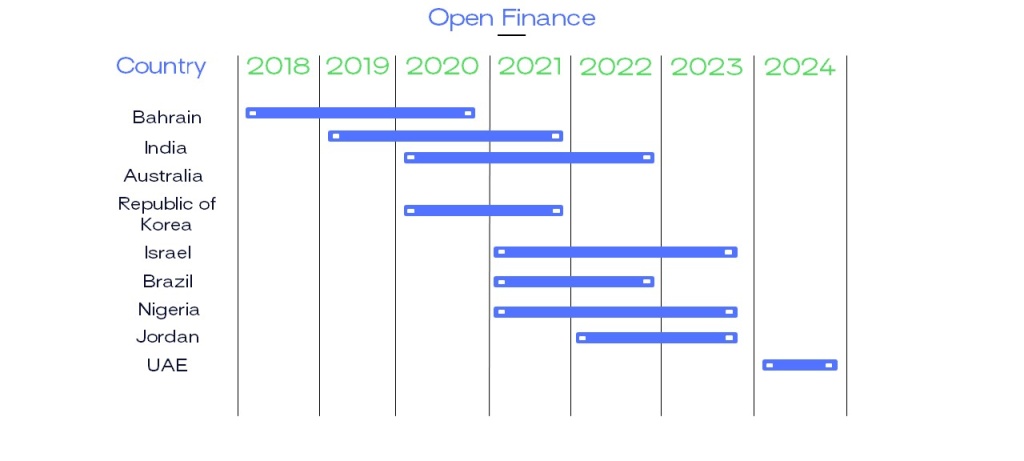

Trends in Timelines

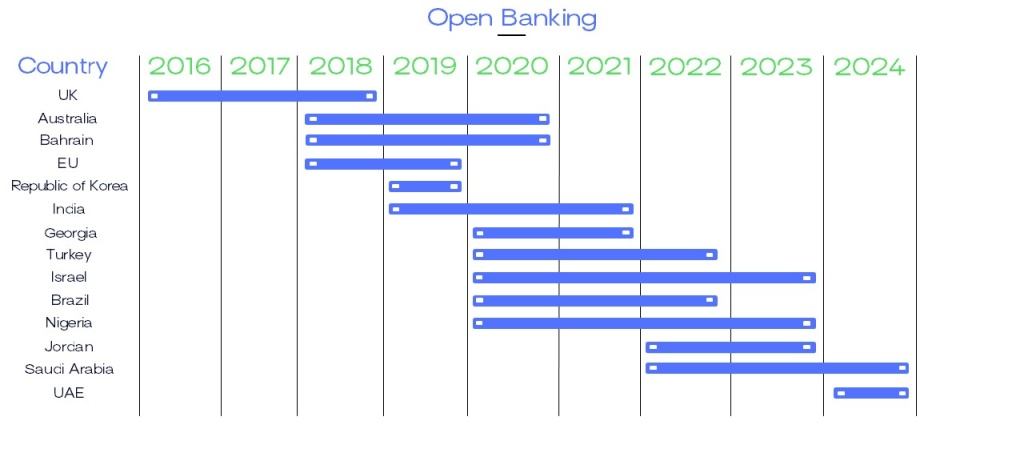

Timeline for year of legislation/regulation/guidance issued vs. year of live implementation of Open Banking and Open Finance:

Source: CCAF

The implementation of Open Banking regimes is heavily influenced by factors such as political opposition and technical infrastructure, which can significantly impact both the speed and manner of adoption.

Trends in Data Sharing

Allowed Data Types:

Regulation-led jurisdictions assess six key categories where financial entities are permitted to share data:

- Payments

- General Insurance

- Savings & Investments

- Mortgages

- Customer Lending’s

- Pensions

Market coverage:

- Advanced markets such as Australia, Brazil, the EU, India and the Republic of Korea, demonstrated broad coverage (all six).

- EMDEs such as Saudi Arabia and Colombia exhibited limited coverage (Payments).

- developing markets such as Bahrain, Chile, Indonesia, Israel, Nigeria and Turkey showed gradual expansion.