“The Global State of Open Banking and Open Finance” Report – Part 1

The following blogpost is based on the University of Cambridge Report “The Global State of Open Banking and Open Finance” which was released in late 2024. In this article, we focus on the first part of the report, on the Open Banking and Open Finance landscape and on what is is all about: what does it imply for financial institutions and for consumers? Who is actually concerned? And more.

Understanding Open Banking and Open Finance

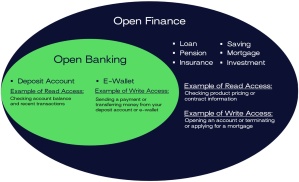

The report provides a visual representation of where Open Banking and Open Finance are located from a product perspective.

Source: Cambridge Centre for Alternative Finance (CCAF)

The different Open Banking ecosystems examined in this report have (at least) one thing in common: they enable consumers to share their payment account transaction data with trusted TPPs (Third Party Providers).

The concept of Open Finance extends the data-sharing and action initiation principles of Open Banking to include a wider range of financial products and product providers (loans, savings, investments, pensions, or insurance).

In technical terms, Open Banking encompasses both access to data (“read access”) and the provision of financial services which entail moving money into or out of their payment accounts (“write access”).

Open Finance could be characterized as the next logical step after the adoption of Open Banking, for example, making it easier for consumers to switch home insurance or mortgage providers if a better deal becomes available.

The report defines four primary policy objectives driving the adoption of Open Banking and Open Finance:

- Improving Competition: Open Banking enables new entrants to challenge traditional banks more effectively without facing the same regulatory hurdles as established financial institutions.

- Fostering Financial and Digital Inclusion: By enabling seamless data transfer between unconventional financial sources, such as mobile money accounts, and traditional financial institutions, Open Finance promotes greater inclusivity and diversity within the financial ecosystem. Beyond simply providing access to accounts, it enhances the breadth, depth and utility of financial services.

- Encouraging Innovation: Access to banking data and systems enables the exploration of novel solutions that cater to evolving customer needs and preferences.

- Enhancing Customer Protection: With robust data sharing pipelines and adherence to strict data protection principles—including data minimization, which restricts access to only the information necessary, and express consent, which mandates unequivocal authorization for data sharing—customers can be confident that their data is handled securely.

On top of primary policy objectives, five groups have been clearly defined as part of Open Banking and Open Finance:

- Customers: They grant consent to data holders to share their transaction data with data users, who can then utilize the data based on the customer’s instructions.

- Data Holders: These institutions, typically banks and credit card providers, also known as Account Servicing Payment Service Providers (ASPSPs).

- Data Users: Data users, also known as data receivers or TPPs. With the customer’s consent, these entities receive the customer data from the data holder and use it to develop new products and services.

- Account Information Service Providers (AISPs): A TPP which is authorized to retrieve data regarding a payment service user’s payment account.

- Payment Initiation Service Providers (PISPs): A TPP that is permitted to provide payment initiation services on behalf of a customer.

- Connectivity Providers: These entities act as trusted and impartial intermediaries, serving as conduits for the flow of data.

- Regulatory Authorities: Depending on the market it may be regulatory driven or not.

Source: CCAF

The first part of the report ends with an explanation of why standards are important in Open Banking and Open Finance as well as the role of regulators.

Role of Standards

Standards refer to a set of guidelines, specifications, and protocols that govern how participants connect to each other. Inconsistency across these standards can still lead to confusion and friction. Below are several examples of Standards:

- UK – data holders (mainly banks) were required to adopt a common and open standard specification for their Open Banking APIs as approved by the CMA.

- EU – banks were required to make account data accessible to TPPs but were not specifically mandated to use APIs.

- Republic of Korea – the adoption of a standardized API framework has enhanced interoperability and data sharing among financial institutions and FinTech’s, fostering a more competitive market.

Why are standards so important in Open Banking and Open Finance?

- Interoperability: Standards facilitate interoperability by providing a common language and set of protocols for data exchange, allowing different entities to communicate, share information seamlessly and collaborate effectively.

- Security

- Customer Protection: Standards in Open Banking and Open Finance often include provisions for customer protection, such as informed consent, data privacy and liability frameworks.

- Regulatory Compliance: Standards often align with regulatory requirements and guidelines set by regulatory bodies

Role of Regulations and Enforceability

To ensure the enforceability of technology and standards, a regulatory authority and framework is valuable, as they provide the necessary oversight to maintain compliance among all participants in the ecosystem.

Open Banking and Open Finance systems rely on the active participation of both supply-side actors, such as data holders (typically banks), and demand-side participants, such as data users (typically TPPs utilizing the data to deliver services).