Frictionless instant payouts

SCA-exempted Open Banking payments initiated from a secure environment

SCA-exempted Open Banking payments initiated from a secure environment

SCA-exempted A2A outbound payments

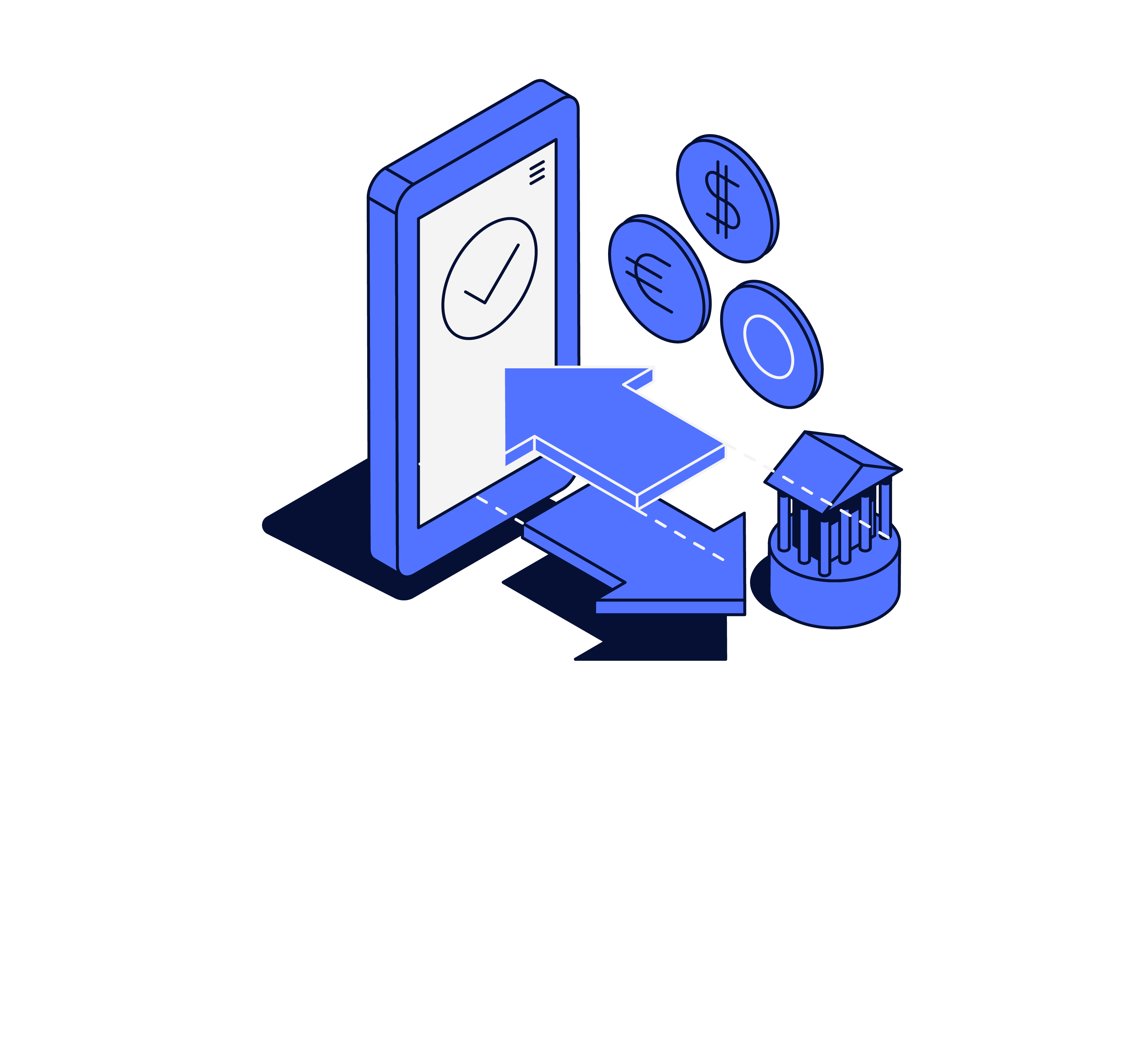

Trusted Corporate Pay, or TCP, is an extension of ONE PAY. It provides all companies as well as public institutions with a new experience: payment journeys are smoother than ever, with no friction at any stage for all stakeholders involved.

By leveraging LUXHUB’s PIS license, redundant and heavy payment routines are turned into an easy task, reducing the processing time. By initiating A2A payments directly from back-office ERP applications with no additional SCA required, employees or civil servants can create instant refunds or payouts. In a secure environment and in just a few clicks.

Built on the LUXHUB ONE unified API and more specifically with extended ONE PAY features, Trusted Corporate Pay is destined to companies and public institutions.

- INITIATE INSTANT PAYOUTS through multiple Luxembourgish banks by using a single API without the need for banking SCA.

- Payments can be sent to any participant of the EUROPEAN SEPA (INSTANT) NETWORK.

- NO AUTHORIZATION PROCESS REQUIRED for each transaction at the bank’s side.

- INITIATE PAYMENTS 24/7 ALL YEAR ROUND – not limited to business hours.

- EASY MAINTENANCE AND IMPLEMENTATION, as it uses one single API.

Through Trusted Corporate Pay – and therefore Open-Banking powered account-to-account payments – any organization can turn their high-volume payments routine into an easy and smooth task, reducing preparation and submission time.

- An employee starts a payment – payment details are already known, such as debit account, credit account, payment amount, payment reference, etc.

- The company’s back-office system forwards the request to LUXHUB.

- LUXHUB obtains the access token from the provider (if required) and prepares the payment request with the required information, such as signature, authorization for the provider selected, etc.

- The payment initiation request is transformed to match the bank’s initiated payment API specification and forwarded.

- The bank makes additional verification of the company’s signature and the payment details integrity before sending back the response for the SCA-exempted payment initiation request.

- LUXHUB forwards the successful response along with the payment unique reference and execution status.

Enter the era of Embedded Finance

Get in touch today with the team to discuss your challenges and discover how we can support you in your overall digitalization processes.