Verification of Payee

A beneficiary name-account details matching service to enable verified and safe transactions for ALL credit transfers. Leverage the expertise of an EPC VOP Scheme-compliant RVM.

A beneficiary name-account details matching service to enable verified and safe transactions for ALL credit transfers. Leverage the expertise of an EPC VOP Scheme-compliant RVM.

Payee Verification Platform enables you to comply with the Instant Payments Regulation, which modifies SEPA rules to enable safe(r) credit transfers

It notably establishes the Verification of Payee (VOP) obligation for credit institutions offering the service of sending of Euro Instant Payment: “PSPs should therefore provide a service ensuring verification of the payee to whom the payer intends to send a credit transfer (service ensuring verification)”.

Interested? Get in touch

Discover Payee Verification Platform

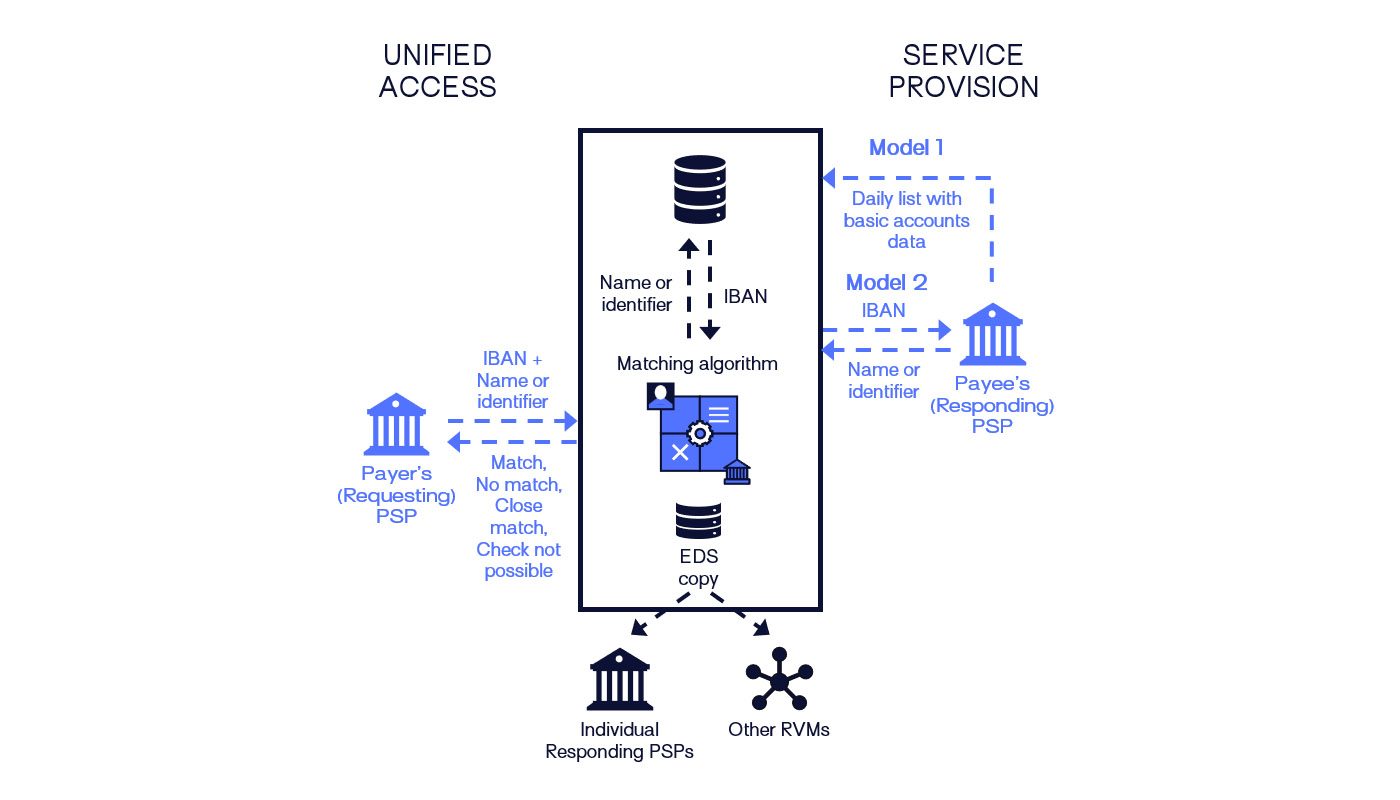

- VOP SERVICE PROVISION: Supports PSPs to expose and manage, in a secure and compliant manner, a real-time name & account details verification service.

- VOP UNIFIED ACCESS: Offers payers’ PSPs a single interface to access verification service made available by the payee’s PSPs.

Comply with the IP regulation as PSP of the account receiving the payment

- MUTUALIZED EXPERTISE, development and setup efforts and costs

- POWERFUL NAME MATCHING ALGORITHM developed specifically for bank account naming specificities

- EASY TO IMPLEMENT AND MAINTAIN PROCESS FOR ACCOUNT LISTS import with built-in validation and reusing existing technical integration

- Data storage in a SECURED, ENCRYPTED AND SILOED MANNER

- API FALLBACK OPTION if the bank prefers an ad-hoc access to each account details

Comply with the IP regulation as PSP initiating any credit transfer

- SINGLE INTERFACE TO VERIFY potentially any European recipient account no matter the source or scope of the check

- FLEXIBLE TECHNICAL INTEGRATION (endpoints for single and batch checks, web portal, etc.) to implement the service in various initiation touchpoints

- DIRECT 1:1 partnerships with RELEVANT DOMESTIC AND INTERNATIONAL SCHEMES AND HUBS

- With ONE CHECK, POTENTIAL TO OFFER/RESELL THE SERVICE to your corporate customers

Download the Verification of Payee White Paper

TACKLING THE VERIFICATION OF PAYEE CHALLENGE

- Comply with IPR

- Adhere to the VOP Scheme

- Connect with European PSPs

- Enable secure credit transfers

Get in touch

Want to learn more about our Payee Verification Platform?

Ensure a smooth compliance with the European Commission’s regulation on Instant Payments and credit transfers.