OECD Report Recap: Shifting from Open Banking to Open Finance

As we are moving from Open Banking to Open Finance, and therefore beyond payment/transaction data, OECD investigated and analyzed different types of data sharing frameworks. The report, published on January 27th, is based on 34 responses to the OECD Survey by 31 OECD countries, as well as by three non-OECD member countries Brazil, Hong Kong (China) and South Africa.

As highlighted in the first pages of the report, “Open Finance could be described as the next stage in the evolution of Open Banking-type of data sharing arrangements”. Currently, data sharing frameworks vary significantly depending on the entities obliged to make data shareable; the type of customers entitled to share data; how data is shared between the parties; and the entities with which data can be shared. OECD expert also underlined that “the timing of the data sharing (real time vs. deferred) and the standardization of transmission mechanisms (e.g. APIs) make a huge difference between both frameworks in terms of the usability of data”.

Open Finance could be described as the next stage in the evolution of Open Banking-type of data sharing arrangements

Frameworks for Open Finance

To this day, most OECD countries have established specific frameworks for Open Banking, and EU member countries have transposed PSD2 into national law, setting the basic requirements for allowing access to accounts. In Japan, the Banking Law now promotes Open Banking initiatives, with banks opening their APIs so that Fintechs can access the bank’s system: more than 90% of banks have concluded API agreements with one or more electronic payment service providers.

Some countries have already extended their frameworks to Open Finance:

- Australia has established a framework for energy data sharing, the telecom sector has been designated and other Open Finance sector are already under consideration by the local government

- Brazil covers multiple additional areas: insurance, open pension funds, investment and foreign exchange

- In Israel, sharing of information includes securities and deposits

- In South Korea, the Korea Financial Telecommunications and Clearings Institute established an Open Banking platform, which supports data related to payments, transactions, insurance, etc.

The report explains that most OECD countries are planning or are in the process of discussing further development of their data sharing frameworks and/or their expansion to other sectors beyond payments/transactions:

In the EU, the revision of the PSD2 legislation and the Open Finance consultation pave the way for developments in this area

Data sharing arrangements and frameworks enable innovation and the development of new products and services in the banking/payment sector, and beyond. As underlined by the OECD experts, “such schemes can provide a secure, controlled and convenient operating environment to allow banks and FinTechs or other third-party service providers to work together and develop innovative and integrated banking services that improve customer experience, while keeping up with international developments in the delivery of banking services”. Moreover, this promotion of innovation can have a knock-on positive effect on competition conditions. And of course, customer experience is enhanced by allowing for the possible provision of more efficient and less costly services, while fostering competition in the market for financial services in particular. End clients are empowered: financial services customers become masters of their data and possess and control the data they provide and compile for them under such data access and sharing arrangements. Finally, bringing third parties into a regulatory framework to ensure data security and consumer protection is another important objective.

Operational and technical specifications

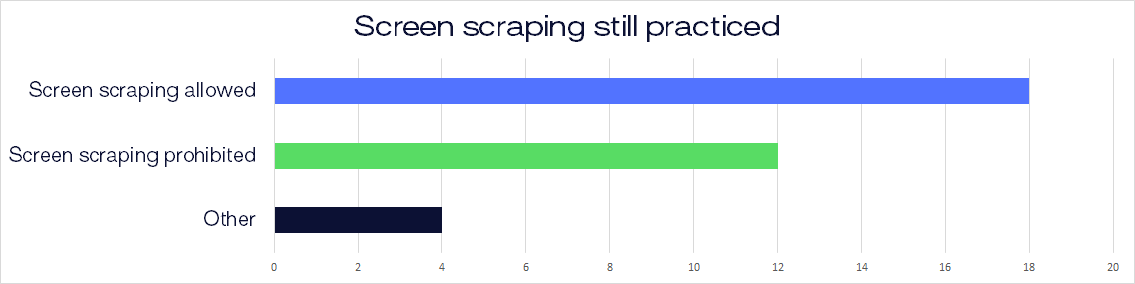

“Open finance APIs allow third party providers to access consumers’ transaction data without the consumers having to share usernames and passwords and eliminate the technical burden of screen scraping,” add the OECD experts. These types of direct connections therefore replace credentials with tokens, and deliver higher levels of security, faster speeds, and higher connection success rates.

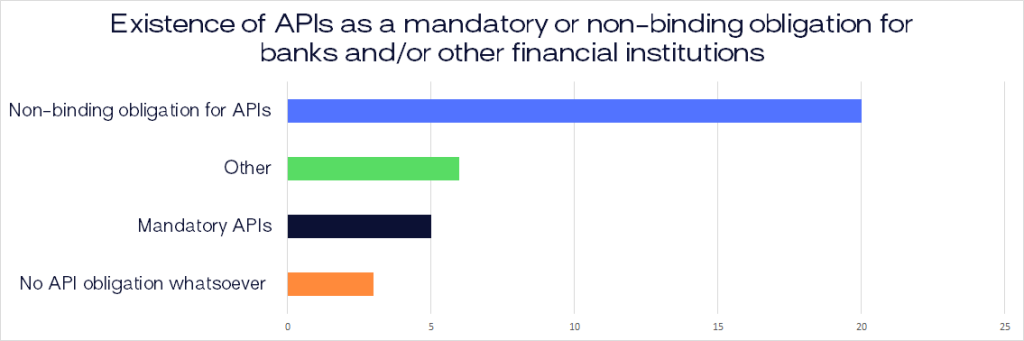

Five OECD countries that took part in this survey reported having APIs as a mandatory obligation for banks and financial institutions under data sharing frameworks. In the UK, a binding obligation has been imposed on the 9 largest banks to implement and maintain specified read and write access APIs. In Turkey, APIs are not mandatory and web services and file transfer protocols are used as an alternative method. We can also note that Switzerland has issued a recommendation to use certain API standards.

Source: OECD survey

Some countries are seeing screen scraping as another alternative method, yet, the US Treasury Department noted the significant security risks and liability burdens of screen scraping and the potential for APIs to provide a more secure method of accessing consumer financial data (report dating back from July 2018).

Source: OECD survey

Source: OECD