Noticeable efforts & new entrants: the ever-evolving Open Finance landscape

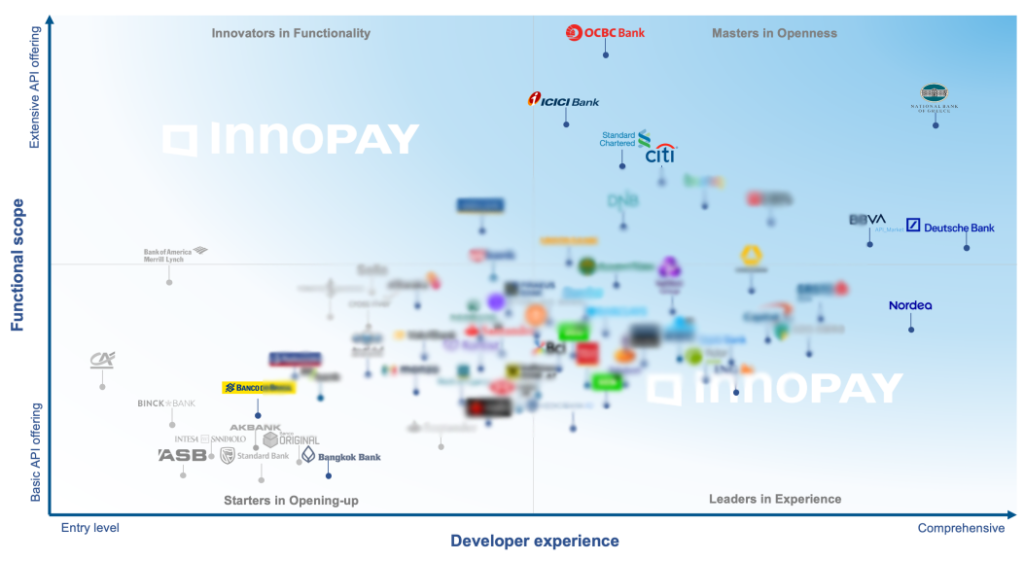

INNOPAY just updated its renowned and recognized Open Banking Monitor, which, as the name indicates, keeps track of the latest developments in the Open Banking/Finance landscape.

The report starts with a compelling quote: “with companies increasingly embedding financial services into their offerings, financial institutions should now be deciding what role they want to play in these Open Finance ecosystems”.

Competition is intensifying

INNOPAY first highlights that existing players are stepping up their game, by expanding their API product offering but also in improving the developer experience for API consumers. Moreover, several new players have entered the Open Banking world.

To access the full map, download the report.

Growing API product offering

According to the latest Open Banking Monitor, banks are offering more APIs (+17% in APIs offered per bank). Those APIs cover a broader variety, yet, account information, payment initiation and payment management are still on top of the list.

One can also notice that several corporate APIs have entered the market, focusing on driving efficiencies and providing improved customer experience in transaction banking operations.

With 25% of APIs still dealing with payments, let’s have a look at some of the most promising use-cases:

- Business instant payments

- Real-time status tracking

- Payment pre-validation

- Request-to-pay

Improved developer experience

As highlighted in the report, the average developer experience score has increased by 11%.

This is notably driven by a 22% increase in Community Development (news articles, blogs, events, etc. showing that banks are aware of the importance of building a community to enable Open Banking as well as innovation).

When it comes to Developer Usability, an increase of 21% can be noticed: it consists in adding or optimizing development tools (sandbox functionalities, detailed ‘getting started’ guides, credential management features, etc.).

Finally, INNOPAY underlines a 3% increase in API Documentation (information on API business context, API versioning & changelogs, etc.) that aims at improving the overall readability of the API documentation and related content.

“Open Finance is a game changer that challenges financial institutions to rethink their business models and get involved in order to unlock business value and secure their relevance,” conclude the INNOPAY experts, also that Open Finance is key to financial service providers wishing to compete and collaborate in digital ecosystems by embedding their value propositions.

Source: INNOPAY