Navigating the VoP obligation: the specific case of PIs & EMIs (Part II)

The Payments Association EU, along with LUXHUB, organized a special digital session focusing on the Verification of Payee (VoP) obligation and especially on how it will impact Payment Institutions and E-Money Institutions. Anne-Sophie Morvan and Ramzi Dziri took the stage, and shared their expertise on the VoP topic.

Specific VoP considerations for PI/EMIs

Because of their specificities, PI and EMIs are particularly concerned by the Verification of Payee obligation, that has been, in the IPR, mostly described from the ‘classic’ perspective of credit institutions. Why is it so specific? There are various business models involving different credit transfer flows and types of payment accounts, and some of payment flows involve credit institutions who need to fulfill the same obligation. The DG FISMA Q&A published last July provided a confirmation with some clarifications regarding several specific cases. Here are some of them:

- Transfers to omnibus accounts (case of accounts involving both a credit institution and an EMI/PI): the provision allows discretion for the PI/EMI and the credit institution to agree between themselves which one of them will provide the feedback (on the outcome of payee verification) to the payer’s PSP. In practice, this would/could be influenced by the type of arrangement between the PI/EMI and the credit institution.

- Transfers to an account with multiple holders: if the account number is not sufficient, additional information to identify the payee should be collected by the payer’s PSP. It should be provided by the payer with other VoP relevant information about the payee.

- Transfers initiated to a proxy-identified account: in case of use of a proxy of the payee (for instance, a phone number) instead of an IBAN, the VoP obligation applies since it is a SEPA credit transfer based on an IBAN. The PSP should inform the payer in a way that allows the latter to validate the payee before authorizing the transaction (displayed information could be the payee name or the identifier used by the service)

- Collected e-commerce payments involving an acceptor/collecting PSP: in this case, the actual payee is the merchant receiving the funds. A VoP check is performed on the merchant, not on the payment facilitator. There is an additional specific case: if a PISP provided the payee information (not the payer directly), the obligation is on the PISP to ensure the payee information is correct.

- P2P transfers between e-wallet accounts (where the account owner and the e-wallet owner are different): in such a case the VoP has to be performed on the account owner.

- Transfers towards ‘known’ payees (whitelisted accounts): those transfers do not benefit from an exemption, VoP service is required for every credit transfer (unless PSU opt-out or non-presence for paper orders)

- ‘me-to-me’ credit transfers (transfer of funds between accounts PSU owns with other PSPs): VoP service is required for every credit transfer (even if the account ownership was pre-validated). VoP cannot be used for the optional pre-validation of account ownership.

Understanding the VoP Scheme

Ramzi Dziri then explained that it is “critical to establish minimum Verification of Payee flows, and data consistency. On the one hand, the VoP scheme will help reduce integration complexity, as there are more than 5,000 registered PSPs in Europe. On the other hand, the Scheme requires implementation from PSPs to be operational”.

The LUXHUB Head of Product also focused on the EDS (EPC Directory Service), highlighting that registration into it is necessary for a potential participation in it, followed by an adherence agreement. The EDS is neither an RVM nor provides a technical connection to scheme participants’ VOP APIs. “It is a directory that stores and maintains all required operational data about participants to enable the interoperability between Requesting and Responding parties (adherence data and API endpoints)”, he added. Moreover, from February 2025, all SCT and/or SCT Inst scheme participants that will not have provided to the EPC a formal opt-out notice by 31 January 2025, will be invoiced by the EPC for the 2025 VOP scheme participation fee and for the EDS setup fee.

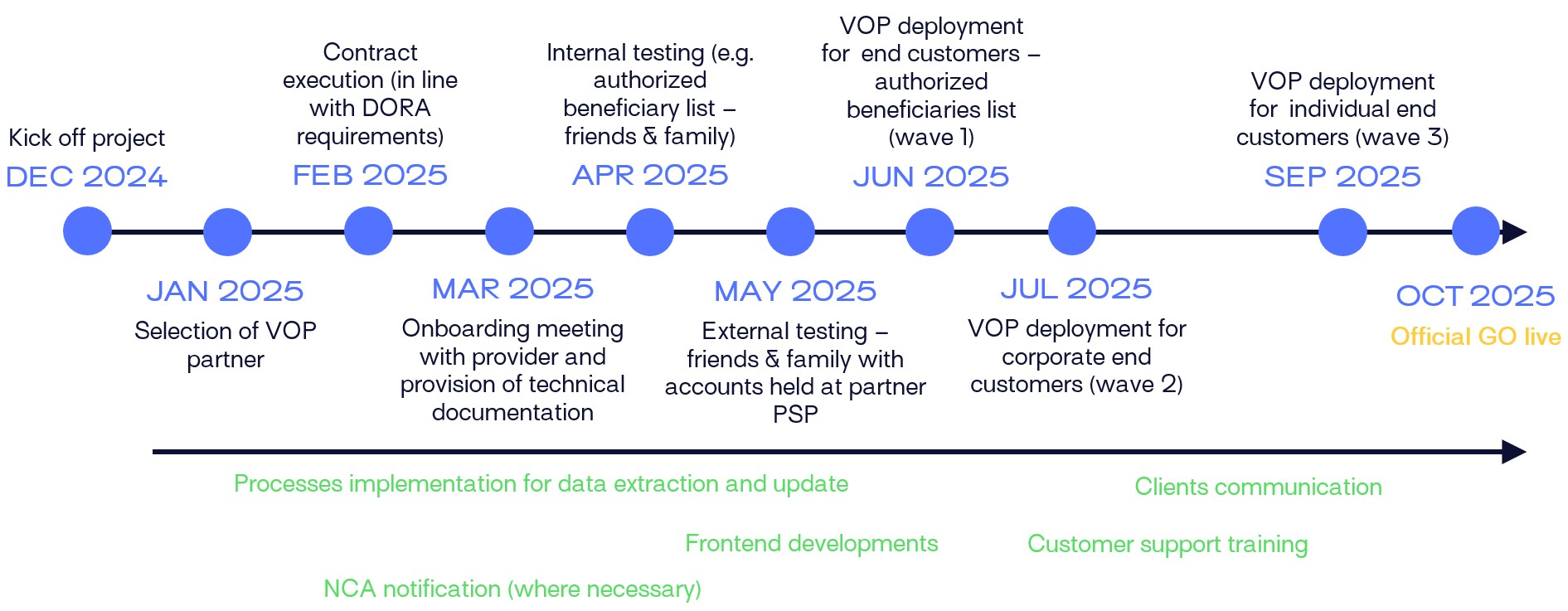

Given the scope of the implementation project, including the adaptation of banks’ touchpoints and payment flows, and the complex task of providing and connecting their respective VoP service, the experts ended the session with a VoP implementation project simulation. It could start with an internal project kickoff taking place by December 2024, followed by the selection of the VoP partner early next year, and several other steps (onboarding meetings, internal and external testing, etc.) to finally deploy VoP for individual end customers by September 2025, several weeks before the official Go Live on October 9th, 2025.

At LUXHUB, we’ve developed the Payee Verification Platform, an efficient VoP solution, consisting of:

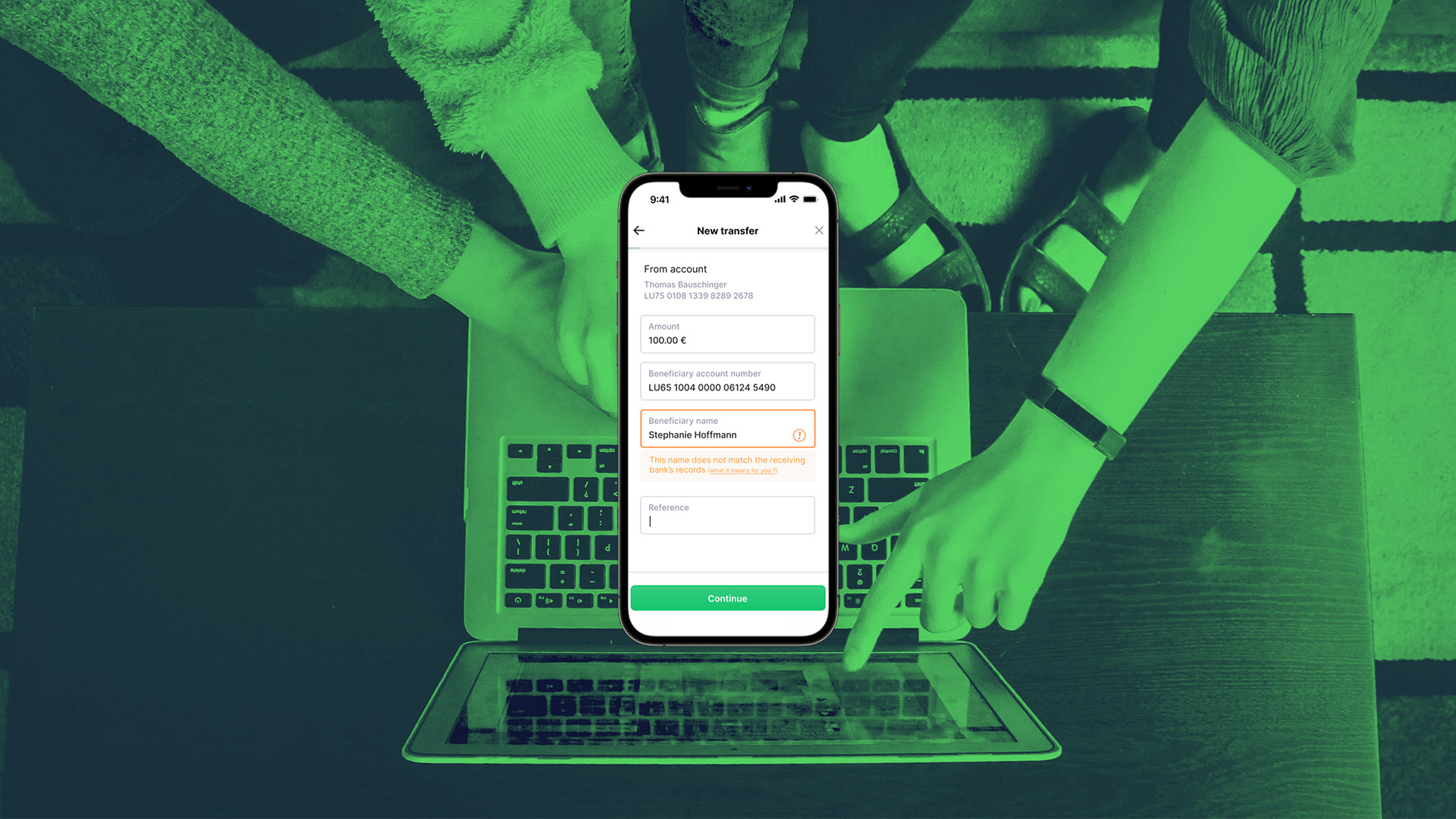

→ VoP SERVICE PROVISION: Supports PSPs to expose and manage, in a secure and compliant manner, a real-time name & account details verification service.

→ VoP UNIFIED ACCESS: Offers payers’ PSPs a single interface to access verification service made available by the payee’s PSPs.