Marketplace Banking: a community hub for financial innovation

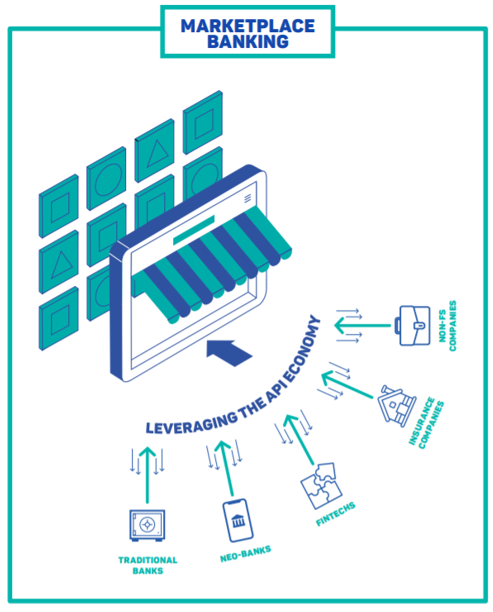

The financial services industry is evolving at a fast pace, driven by tech innovation, regulatory change and increased competition. Moreover, banks and financial institutions are constantly adapting to the new needs of their customers, who are now looking for real-time solutions, tailored products, enhanced user experience and much more on top of this. Over the last few years, many banks have leveraged the potential of APIs to surf the transformation wave. To do so, they have had to adopt the concepts of ecosystems and marketplaces, enabling rapid innovation and efficient product development.

We’ve discussed these key concepts with Jacques Pütz (CEO of LUXHUB) and Olga Gamayunov (Open Banking Product Manager, LUXHUB), who focus on the emergence of the API economy and the exchange of features and data via the Marketplace.

Marketplace: a one-stop-shop to foster innovation

“Whether in the retail industry or the world of social media, many sectors have embraced ecosystem models, in C2C, B2C and also B2B, enabling an exchange between sellers and buyers, providers and consumers,” starts Jacques Pütz.

Such platforms are now extremely popular, especially within the B2C sector, with small, creative businesses able to reach new clients, who are attracted by the ability to access unique products in a secure and trusted environment.

It’s a win-win situation for both sellers and buyers, and actually a win-win-win situation if we include the platform in this too.

Nowadays, just like in any other industry, traditional financial institutions sim[1]ply cannot develop, offer and/or manage best-in-class services in-house, and can easily turn to Fintechs that specialize in specific domains and tasks to help them refine and improve their services.

Olga Gamayunov comments: “Fintechs are not trying to compete with banks anymore, but rather to become added-value suppliers, addressing specific and important pain points. Their services are seamlessly integrated within the overall value chain of the financial institutions, often with white-labelled solutions and of course APIs.”

By providing them – banks and Fintechs – with a platform to offer and consume innovative services, the LUXHUB Marketplace aims at becoming a key enabler and facilitator of digital transformation.

In this context, the ecosystem/marketplace model is a great fit for the highly regulated financial services industry, with more players mutualizing their efforts, sharing their knowledge and leveraging the capabilities and specific expertise developed by third-party providers.

Read the article published in the latest Trans-for-Nation magazine