LUXHUB partners with SnT to power Open Finance with innovative AI methods

LUXHUB, the Open Banking and Finance pioneer built from the necessity for banks to mutualize their PSD2 compliance efforts, is announcing a strategic partnership with the University of Luxembourg’s Interdisciplinary Centre for Security, Reliability and Trust (SnT) to create added value services based on financial data.

The partnership will implement ground breaking technology in the field of artificial intelligence, while respecting the industry’s main concern: the safety and privacy of sensitive data. Experts from both LUXHUB and the ICT research program are working hand in hand on a federated learning model, for the benefit of the entire financial services industry.

Artificial intelligence will benefit Open Banking & Finance

In our current digital environment, an increasing amount of data is being produced daily, with financial institutions leveraging customer information to provide tailored services while adding more value to their own products. Some are also investigating the use of data to better protect their customers and reinforce trust relationships.

Several disruptive technologies and machine learning models are already available, helping banks, insurance companies and others to achieve these new objectives.

In the era of Open Finance – with financial services companies collaborating, co-creating new products and services by taking advantage of the API economy – it makes sense for them to opt for the federated learning model, and keep building the future of finance. Together.

Claude Meurisse, COO of LUXHUB

This specific model was introduced by Google back in 2017 with, at that time, a focus on user interaction on mobile devices, and is now perfectly suited for the financial services industry.

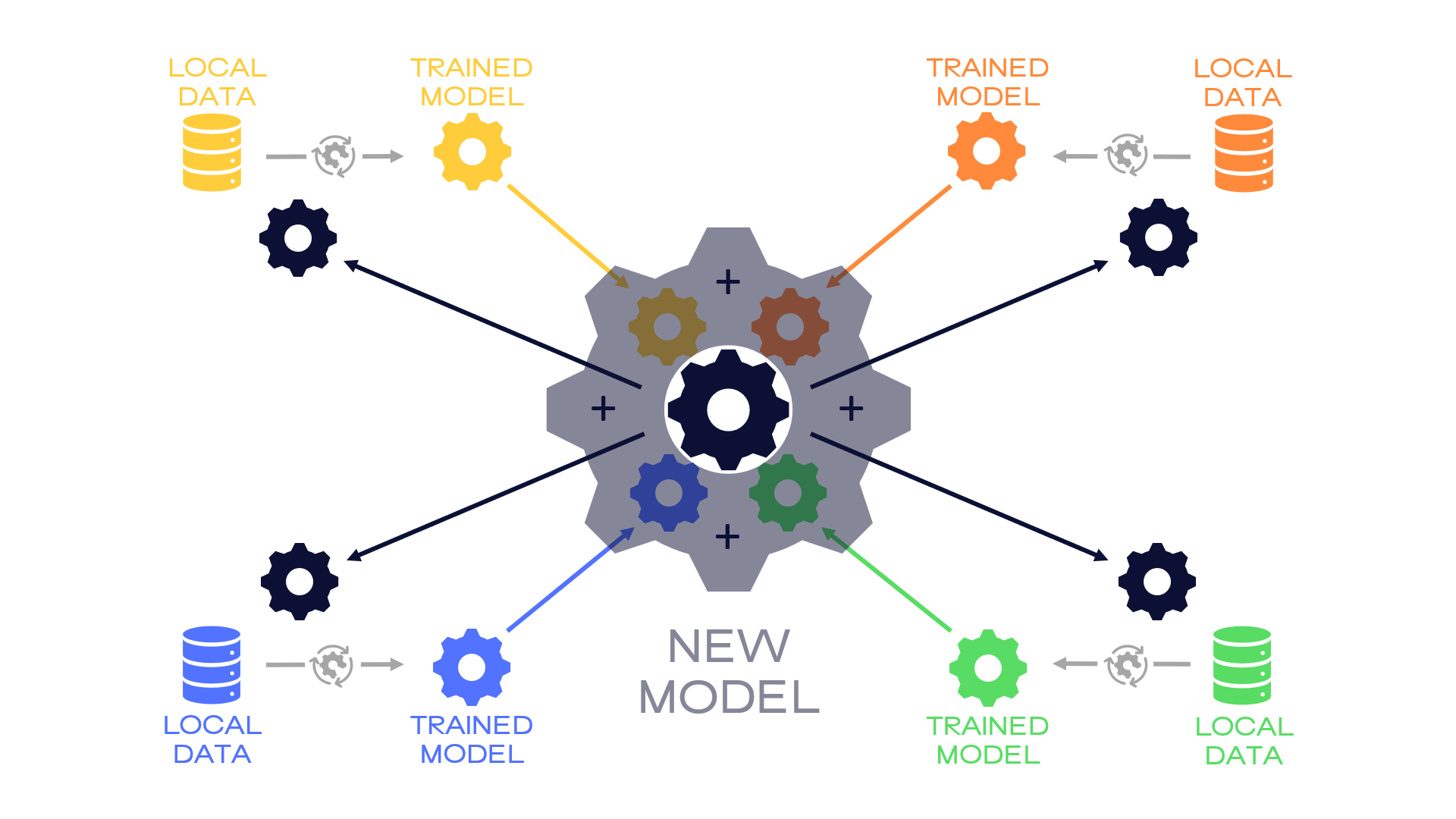

Training a centralized model on decentralized data

The COO defines federated learning as “a machine learning procedure, where the goal is to train a high-quality model with data distributed over several independent providers, such that the data remains locked on each provider, and no centralized data storage is actually needed.”

Federated learning differs from most machine learning models, as the algorithm – and NOT the data – travels. Claude Meurisse highlights: “Joint predictive models are shared and created by what is called the federation. And eventually, all participants learn from everyone without learning from anyone.”

By opting for such a model, LUXHUB and SnT are making sure data never leaves the premises of the client/participant, and therefore security and confidentiality are ensured.

“Federated Learning allows training a model on your own data without sharing the data with someone else; you just share updates to a global model. The data stays on each client’s premises – in the case of a bank, down to a single branch – to avoid any risks, but the system allows every participant to leverage their collective intelligence to train the global model,” said Prof. Radu State, head of the Services and Data Management (SEDAN) research group at SnT, and principal investigator of the research project in federated learning for PSD2-compliant data analytics.

It’s a win-win: everyone is better off by collaborating, while ensuring data security and privacy at the same time

Radu State, Head of SEDAN Research Group, SnT

Claude Meurisse lists more benefits to leveraging federated learning in the financial sector, from lower latency and less power consumption to a significant decrease in false positives and an important decrease in operating costs.

Key use-cases to benefit the financial sector

LUXHUB, as a central and neutral piece of this data puzzle, aims at enabling more interaction and innovation within the financial services industry. “LUXHUB is all about fostering innovation and collaboration. That is what we have been doing since our very inception, being created by four major banks to mutualize their PSD2 compliance efforts. Collaboration is deeply rooted in the company’s DNA,” underlines Claude Meurisse.

More concretely, the participants – mostly banks, for the time being – will power an algorithm, making it more powerful, efficient, and accurate, allowing the financial institutions to take better-informed decisions. The training of the algorithm will be assumed by the LUXHUB team in collaboration with researchers from SnT’s Services and Data Management research group, led by Prof. Radu State, turning the Open Finance hub into a data processing specialist.

The first phase of the project will consist in the design and management of a secure federated learning platform. “In parallel, our team will be focusing on several key use-cases that will benefit the entire financial services industry, such as fraud detection, anti-money laundering, loan risk prediction, and transaction categorization,” comments the COO. According to him, the model could then be extended to additional use-cases, dealing notably with key compliance topics, and more.

“With LUXHUB acting as a coordinating hub, and by leveraging the knowledge of SnT researchers, the federated machine learning system has the potential to improve current efforts to tackle key sector challenges, notably to identify illicit financial activity, by enabling shared learning without sharing data,” adds Claude Meurisse.

The project outcomes have tremendous potential allowing the design of solutions that leverage data across several stakeholders in a secure and compliant manner

Björn Ottersten, Director of SnT