How – and when – to adhere to the EPC VOP Scheme

The Verification of Payee deadline is just 5 months away. And time is ticking for Payment Service Providers (PSPs), especially with the window of Wave 1 of the European Payments Council (EPC) VOP Scheme adherence process about to close (on May 15th). Today, let’s have a look at the entire process, and also at how RVMs (Routing and/or Verification Mechanisms) can support PSPs in it.

A lot of documents have been published since v1 of the EPC VOP Scheme Rulebook back in October 2024, from the API Security Framework to the EDS Onboarding and Registration Guide.

The VOP Scheme Adherence process is documented in the “Adherence Guide to the EPC VOP Scheme” (EPC071-25), which was published on March 24th, 2025. The guide is directed at institutions wishing to join the Scheme as “Scheme Participants”, but also at Agents applicants (National Adherence Support Organizations, RVMs, etc.) handling the application of behalf of applicants.

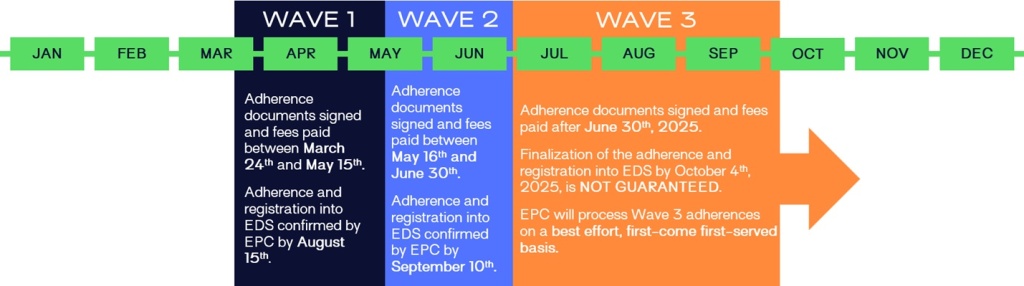

The three adherence waves

As highlighted by the EPC, PSPs should start their adherence process as soon as possible, to ensure their presence in the EDS by October 5th. The window for Wave 1 closes on May 15th. For those going for Wave 2, PSP registration in the EDS should be finalized by September 10th, which gives PSPs less than one month to test and adapt.

Several conditions apply for PSPs to adhere to the Scheme:

- The Applicant must satisfy all the relevant eligibility criteria (be licensed as a PSP as defined under Directive (EU) 2015/2366 and SEPA Regulation; be either incorporated and licensed in a SEPA country or territory, or licensed by an appropriate EEA regulatory body; be able to pay its debts as they fall due, and not be insolvent as defined in accordance with any insolvency law applicable to the Participant; maintain a sufficient level of liquidity and capital in accordance with regulatory requirements to which it is subject; comply fully with applicable regulations in respect of money laundering, sanctions restrictions and terrorist financing; develop and effect operational and risk control measures appropriate to the business undertaken by the Participant)

- The Applicant must have a valid type of identifier

- The Applicant must pay the VOP scheme participation and the EDS related fees

- The Applicant must complete its onboarding in the EDS

- The Application must update its reachability data and its Operational Readiness Date (ORD) in the EDS

Adherence documents and process

An “Adherence Pack” was published and contains all relevant and mandatory documents that PSPs or their Agent must submit. It consists of:

- The Adherence Agreement (Annex H-1) – This is the multilateral contract that will bind the Applicant/Participant with the EPC and each other Participant in the Scheme;

- The Schedule to the Adherence Agreement (Annex H-2) – Where the Applicant is asked to provide basic details in relation to its organization and its application;

- A Legal Opinion (Annex H-3 or Annex H-4 if licensed branch of a non-SEPA country institution), needed for Applicants that are not SEPA Credit Transfer (SCT) or SEPA Instant Credit Transfer (SCT Inst) scheme participants. To be duly completed and signed by an internal/external qualified lawyer, supporting the information provided for the adherence.

There are several ways for Applicants to complete the documents and submit them. Either the Applicant completes its own Adherence Documents (Annexes H-1 and H-2, plus H-3 or H-4 when relevant), or it gives legal authority to an Agent (NASOs or RVMs). The Agent is responsible for and required to correctly execute the Adherence Agreement (Annex H-1) and Schedule (Annex H-2) and obtain a Legal Opinion (Annex H-3 or H-4) when relevant, from either the Applicant’s internal counsel or from an external counsel.

When completing the adherence documents, especially Annex H2, the applicants need to enter the email address which will be used for registration in the EDS. Two options are available: Standard EDS Onboarding (1) or Simplified EDS Onboarding (2). As explained during the latest VOP Scheme documental adherence interactive information session, “Option 1 is suggested to VOP Applicants who want to retain full control over the EDS: applicants not planning to use any RVM, planning or considering to partner with two or more RVMs, planning to make use of EDS APIs, and/or willing to also act as an RVM”. To select Option 1, the VOP applicant needs to enter one of its own email addresses in Annex H2. This email address will then be invited to register in Swift.com. There is a precondition to be able to select this option: the applicant needs to have, or create, its own “Administrator” in Swift.com, and indicate the BIC8 of its Financial Institution during the EDS registration phase in Swift.com.

Option 2, on the other hand, is suggested to the VOP applicant that aims at simplifying as much as possible its EDS onboarding, for instance when the applicant plans to use only one RVM, or when it is not willing to (directly) use EDS APIs, or to act as RVM. To go for Option 2, the applicant needs to indicate the email address of the selected RVM in Annex II. This is the email address that the RVM provided during the RVM qualification process, and it will be linked to the participant BIC in Swift.com and the EDS. Two preconditions are needed to selection Option 2: the VOP applicants has signed – or intends to sign – a contract with one RVM and to delegate the EDS onboarding phase, and the selected RVM has to have successfully completed the EPC’s qualification process for RVMs.

How to submit the documents?

Applicants (or Agents) should submit the documents to the EPC directly, by sending:

- Electronic copies of the Adherence Documents (which is strongly recommended), via email (vop@epc-cep.eu), that are signed electronically. It is also recommended to use the Excel template for H-2, rather than the Word template. Moreover, Applicants should save an electronic copy of these documents.

- The original documents, in a secure way (courier or special delivery) and therefore avoid regular mail.

Step by step guide and instructions for completing Annexes H-1 et H-2:

- Read through the Adherence Guide and template Adherence Documents and in particular the Adherence Agreement

- Download the Adherence Pack from the Toolkit

- Adherence Agreement: fill in the legal name of Applicant

- Adherence Agreement: Applicant/Agent proceeds to signature section

- Schedule: Applicants are required to submit certain details, as set out in the Schedule

- Sending of the Adherence Agreement and of the Schedule

- Pay the applicable VOP Scheme participation and EDS related fees

Step by step guide and instructions for completing the Legal Opinion, if applicable:

- Familiarize with the standard pro-forma template enclosed under Annex H-3 of the Adherence Pack

- Evaluate all the necessary elements and information required

- Assess if the Legal Opinion related to an Adherence Agreement is to be completed and signed by an Agent

- Make sure that the Legal Opinion does not pre-date the Adherence Agreement and that all dates are consistent

- Sending of the Legal Opinion – Evaluation time

What happens once adherence is confirmed?

With the “documental” adherence to the VOP scheme now completed, the Participants will be onboarded in the EDS, and the users indicated in the Adherence Agreement identified by their email addresses will be able to register to get access to the EDS.

The next steps will be fully described in an upcoming article focusing on the EDS onboarding and registration, on how to get started with the EDS GUI, and more.

Need support in your adherence application to the EPC VOP Scheme? Reach out to the LUXHUB team – as an RVM, the Regtech from Luxembourg is authorized to handle it and facilitate the overall adherence process for PSPs.