Heading towards Open Finance: how and when?

Last week, the team attended – and exhibited – at Open Banking Expo UK & EU, which took place in London. The event welcomed experts from all over Europe, with 1000+ participants who got the chance to discover a bunch of innovative solutions, including ours. The discussions revolved around Open Banking, but necessarily also around the next step for all types of financial institutions: Open Finance.

Located in the innovation zone, we notably presented our flagship XS2A solution which enabled us to rapidly become a leading European Open Banking Hub back in 2018, when the concept had just emerged.

We also took the opportunity to share our vision for the future Open Banking, especially with the recent FiDA (Financial Data Access) framework proposal in Europe, and with the numerous initiatives that have been – or that are about to be – launched in all parts of the world. Our eye-catching and neon-like slogan seen on our booth said it best: “Ready for Open Finance?”

The World of Open Finance

In fact, the Open Finance revolution has clearly started after several legislation have been voted, or in-depth discussions are still taking place, in the different regions of the world.

Europe will soon have FiDA, the UK has communicated about its Open Finance call for input, the UAE has opened an Open Finance Lab, Jordan has published Open Finance Guidelines, Japan is reviewing its Open Banking Act, etc., and last but not least, the CFPB (Consumer Financial Protection Bureau) is advocating for the development of Open Banking in the US. Call it however you prefer, but the Open Banking/Finance revolution is well engaged in literally all continents. For the benefit of consumers of course, who will more easily be able to control their data and manage their financial lives, but also for Third Party Providers and financial institutions will have many opportunities to seize.

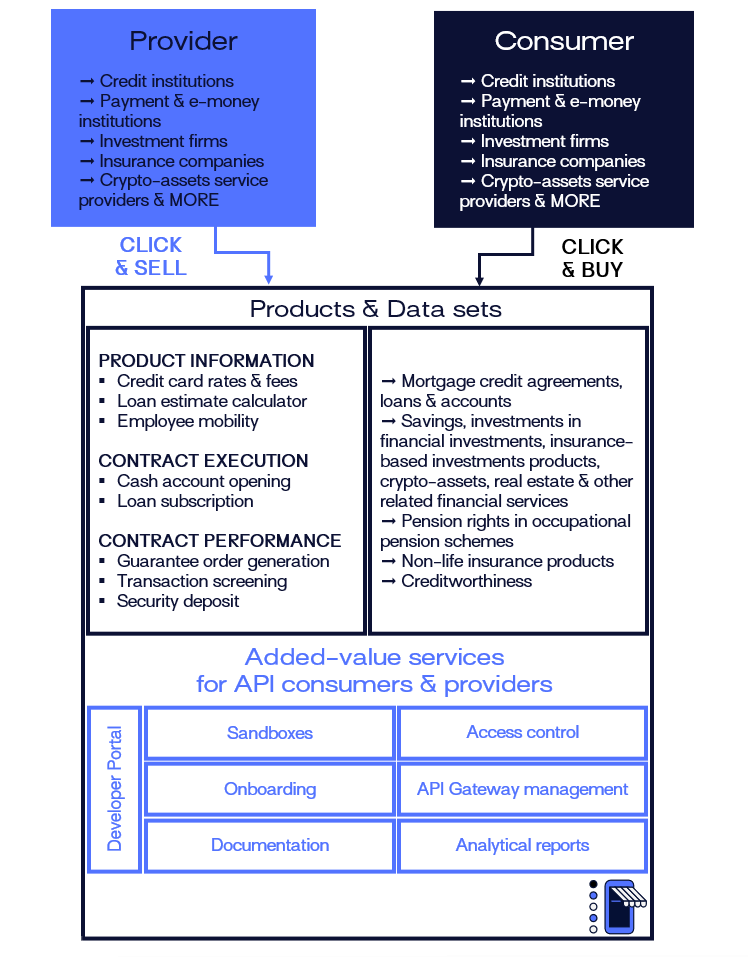

In this respect, LUXHUB is launching its Open Finance Platform which consists in a collaborative platform that enables the secure exchange of financial data, via API, between the financial institutions in scope. And as highlighted in the illustration below, a financial institution could very well qualify as “provider” (or “data holder”) in one specific use case, but also as “consumer” in another one. From sharing (with a special degree of compensation) to using, all financial institutions are in front of a land of opportunities. With this platform, LUXHUB lays the common ground and its related secure rules that will enable efficient and compliant data exchange.

LUXHUB’s Open Finance Platform

Getting ready for Open Finance

In this context and to support all players in their transition to Open Finance, LUXHUB is also taking part in the upcoming Open Banking/Finance Report, crafted by leading Fintech media The Paypers. In this edition, we share our “DO’S & DON’T’S” for companies willing to enter the world of Open Finance and anticipate future legislation.

Here is a sneak peek of our article. The report will be available in late November, make sure to check it out and in the meantime, feel free to contact us to discuss Open Finance, CESOP, Instant Payment or anything related to Digital Finance!

DO’S

- Anticipate your role in this new ecosystem: start laying down your overall strategy because most of your competitors have already started investigating Open Finance

- Help define financial data-sharing schemes: unlike in Open Banking, those are to be defined by industry players. Be one of them.

- Beware of such “compensation strategies”: Data holders can be ‘compensated’, as explained in FiDA. Define your strategy and that very specific topic.

- Etc.

DON’T’S

- Close your eyes and let competitors take advantage: Start laying down your overall strategy because most of your competitors have already started investigating Open Finance

- Do everything on your own: Collaborate with companies that have developed deep expertise in the fields of Open Banking. Pick a partner you can trust.

- There’s more!