From Innovation to Inclusion: South Korea’s Open Banking Journey

In the field of digital finance, one nation is at the forefront of the Open Finance movement—South Korea. South Korea, a major driving force behind technological advancement, has used Open Finance to promote growth, increase competition, and improve financial inclusion. In fact, South Korea stands out as a leading example of Open Banking maturity, ahead of many Asian counterparts.

How it started

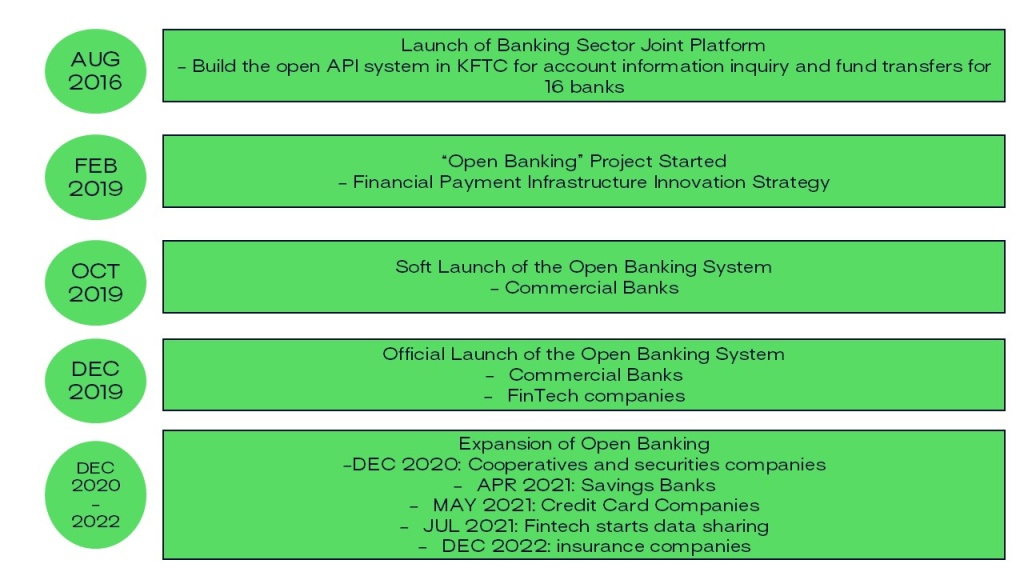

The Financial Services Commission (FSC) and other government organizations outlined ambitious plans for improving the nation’s financial infrastructure in February 2019, marking the start of the journey. With Open Banking at the center of these efforts, the objective was to promote innovation in the Fintech and payment systems industries. On October 30, 2019, the Open Banking pilot program in Korea began, and by December 18, 2019, it was already fully implemented. Over 3 million users created almost 8 million accounts through Open Banking during the pilot period, which ran from October 30 to December 17. As highlighted in a World Bank report, it resulted in 84 million API calls.

According to the University of Canberra, as of December 2024, the number of registered Open Banking users in South Korea reached approximately 203 million, accounting for users with multiple accounts.

But could this be considered the true start of Open Banking in Korea?

Well, we could say that Open Banking started way before, concretely in August 2016, when Korea launched the world’s first ‘Fintech Open Platform,’ according to a government press release. Managed by the Korea Financial Telecommunications & Clearings Institute (KFTC) and the Financial Security Institute (FSI), the platform aimed to promote Fintech innovation. However, its adoption was limited. Only small and mid-sized Fintech companies could access the APIs, while digital banks were excluded. Additionally, the high fees for API usage further restricted its reach.

Some specificities of Korea’s market

Regulatory or Market Driven?

Market-driven: South Korea’s Open Banking initiatives are largely driven by the government, with active participation and regulation by the Financial Services Commission (FSC).

Regulators

Financial Services Commission (FSC): Oversees the Open Banking and Open Finance frameworks, ensures security, privacy, and fair competition in the financial ecosystem.

Financial Supervisory Service (FSS):

Supervises financial institutions and ensures compliance with financial regulations. Works alongside the FSC to enforce rules and manage risk in the financial system.

Korea Fair Trade Commission (KFTC): Enforces antitrust and fair competition laws, ensuring that market participants in the Open Banking sector, such as Fintechs and banks, are operating in a competitive environment.

Open Banking or Open Finance?

Both: Initially focused on Open Banking (payments initiation and account information), now expanding to Open Finance with MyData and plans for more comprehensive financial services.

In Korea, policy initiatives related to Open Banking, Open Finance and Open Data are called Open Banking, Financial Sector MyData, and MyData, respectively.

Core Data

Financial Transaction Data: Balance inquiry, wire transfer, and transaction inquiry services. MyData service also focuses on personal financial data management.

Open Banking/Open Finance Cases

In South Korea, several companies and Fintechs have leveraged Open Banking and Open Finance to offer innovative financial services.

KakaoPay

KakaoPay is a subsidiary of Kakao Corp, a leading messaging and tech company in South Korea. It offers mobile payment services.

- Use Case: KakaoPay is integrated with Open Banking to allow users to make payments, transfers, and even pay bills by linking bank accounts directly to the app.

- Innovations: It enables real-time payments and a wide range of financial services such as loans, insurance, and investments, all accessible through the Kakao ecosystem.

Toss

Toss is one of the leading Fintech companies in South Korea, providing mobile financial services including payments, transfers, and loans.

- Use Case: Toss leverages Open Banking to offer peer-to-peer payments, account linking, and money transfers between different banks in real time.

- Innovations: With its Open Banking capabilities, Toss simplifies the process of managing finances, offering loan services, and even providing real-time credit scores based on user transaction history.

Final words

The Open Banking system in Korea has elements of both regulatory and market-driven approaches. While the Korean government has played a significant role in promoting Open Banking through initiatives like the regulatory sandbox program and the full launch of the Open Banking system in December 2019, the market has also driven its adoption and growth.

The rapid adoption and usage of Open Banking in Korea, with a significant increase in registered users, indicate a strong market demand and participation. By September 2022, the number of registered users for Open Finance reached 54.8 million, showing a nearly fourfold increase from 14.2 million users in January 2022. In addition, with the implementation of the most recent version of the “MyData Scheme”, South Korea is looking to expand into several other industries such as healthcare, telecommunications, and energy. Thus, showing the country’s effort in allowing customers to have control over their data and obtaining the right service for their exact needs.

Therefore, while the initial push and regulatory framework were provided by the government, the market’s enthusiastic response and the proactive participation of financial institutions and Fintech companies have also been crucial in driving the success of Open Banking in Korea.

Sources:

-

https://documents1.worldbank.org/curated/en/099651305202495523/pdf/IDU-234df1fd-6013-43ba-87e5-1981565719ea.pdf

-

https://www.fsc.go.kr/eng/pr010101/81754

-

https://www.fsc.go.kr/eng/pr010101/22141

-

https://www-statista-com.ezproxy.canberra.edu.au/statistics/1238251/south-korea-number-of-open-banking-users/

-

https://documents1.worldbank.org/curated/en/099345001292217326/pdf/P169414-db172279-fc9a-4974-9c31-8bf72418885f.pdf

-

https://thepaymentsassociation.org/article/from-open-banking-to-open-finance-and-beyond-the-future-of-financial-data-sharing/