ACPR Reveals Key Insights on French Open Banking

The Open Banking Report from the French Prudential Supervision and Resolution Authority (ACPR) paints a picture of measured but steady progress. Based on data gathered from the six largest banking groups in 2024, it shows that while PSD2 remains the backbone of open API activity, banks are cautiously extending their scope beyond regulatory use cases. This article unpacks the ACPR’s findings through two lenses: the profile of API providers and the types of APIs they offer, then the landscape of API consumers and how the ecosystem is evolving.

French Banks Take the Lead Beyond PSD2

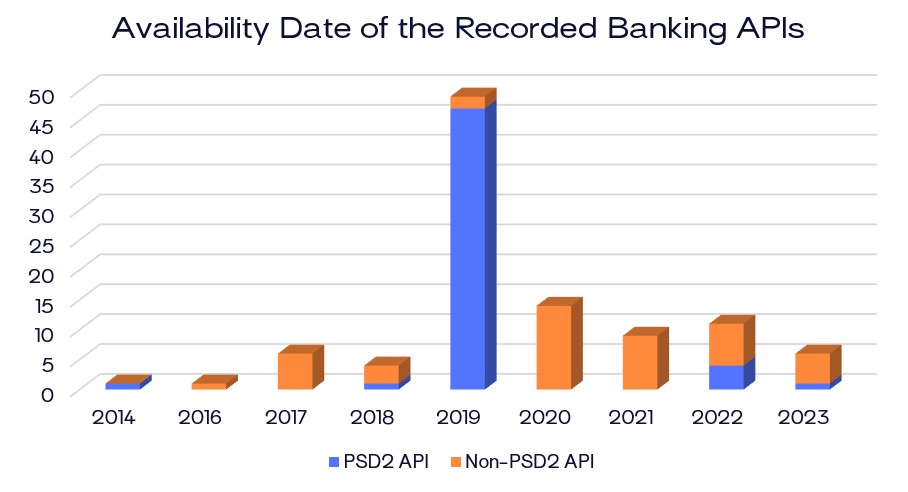

ACPR data highlights a rise in banks’ non-PSD2 APIs availability following the implementation of the Directive and its Regulatory Technical Standards in 2019. This increasing adoption reflects banks’ efforts to move beyond the PSD2 framework and develop new API based products. BNP Paribas CIB, for instance, offers additional interfaces for settlement instructions, corporate actions or index public data. These examples suggest that some large French banking groups consider APIs as important tools to serve their customers.

Source: ACPR Report 11/09/2025

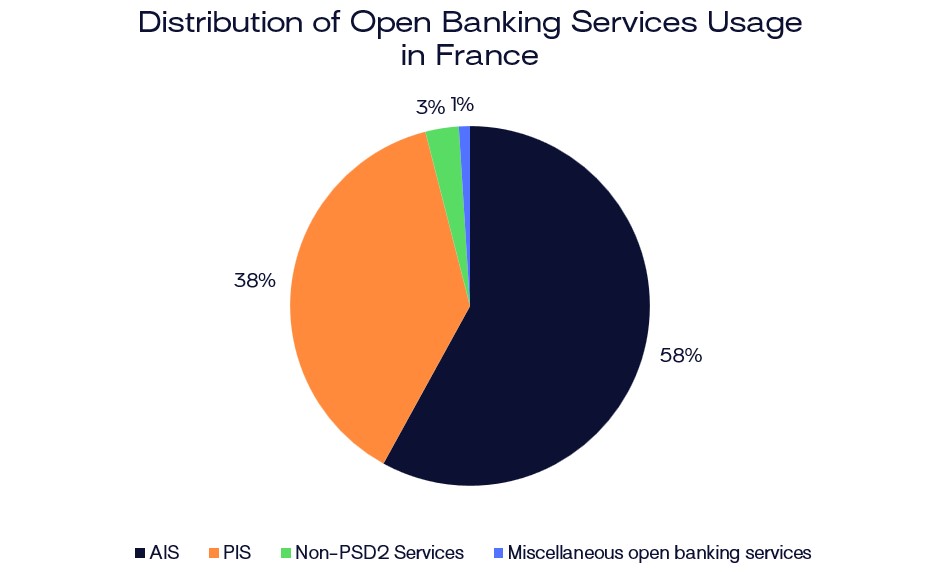

Despite this strategic focus, the report shows that API activity remains predominantly PSD2-oriented with 96% (AIS and PIS combined) compared to 3% for non-PSD2 services. This cautious diversification marks an early, promising shift toward a large API adoption.

Source: ACPR Report 11/09/2025

The ACPR also highlights significant financial commitments: the surveyed banking groups indicated that they collectively invested over €100 million in 2023 for API development, maintenance, and security. This reflects strong institutional engagement but also an individualized model, as each bank has built its own API stack. While this independence can be seen as a strategic advantage, it also creates a more complex landscape for third-party providers and does not enable any cost mutualization. By contrast, in Luxembourg, several banks have adopted a collaborative model through LUXHUB, pooling resources to develop regulatory-compliant products. Such cooperation enhances connectivity between institutions and service providers, reduces duplication, and enables faster deployment of new services.

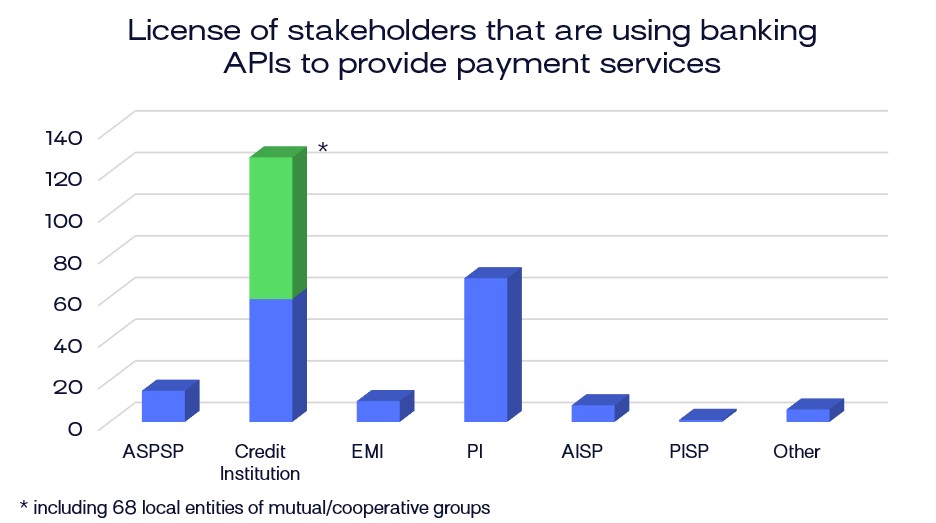

API Consumers: Banks Rival Fintechs in the Race for Integration

On the demand side, the ACPR’s findings show a balanced ecosystem, with banks and Fintechs now nearly equal as API consumers. While the report notes that just 4 Fintechs account for over 75% of AIS customer volume, banks are significant API consumers. This behavior suggests that banks also seek to capitalize on PSD2 opportunities, despite numerous official negative reactions on Open Banking success.

Source: ACPR Report 11/09/2025

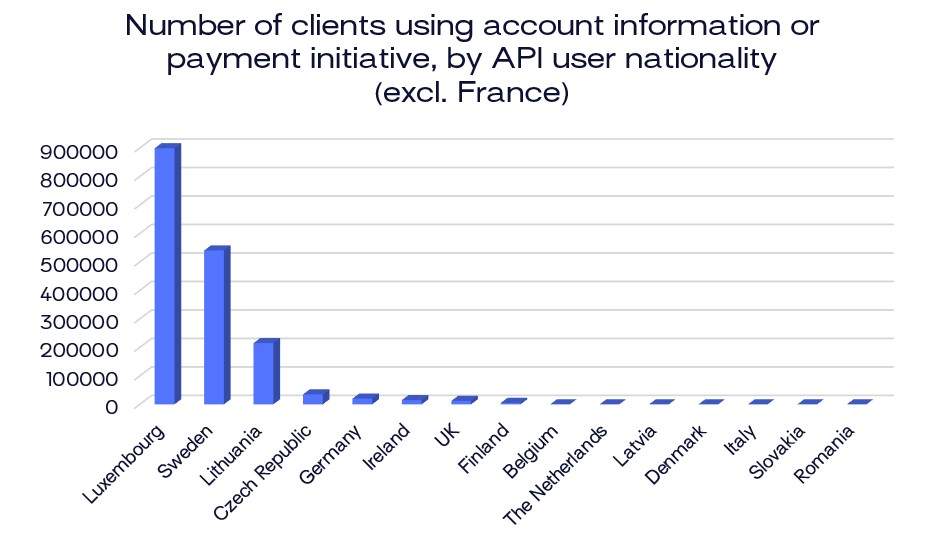

ACPR data also highlights Luxembourg as a leading market for API usage outside France, showing high client adoption of account information and payment initiation services.

Source: ACPR Report 11/09/2025

Conclusion: Open Finance as the Next Step

These findings should be considered alongside reports from French third-party providers and the European Commission impact assessment. Although progress remains cautious and uneven across the market, banks gradually move towards Open Finance. To fully realise this next phase, a stronger regulatory push appears necessary to enable its comprehensive deployment.