Discussing FiDA and Open Finance: Anne-Sophie Morvan x Rik Coeckelbergs

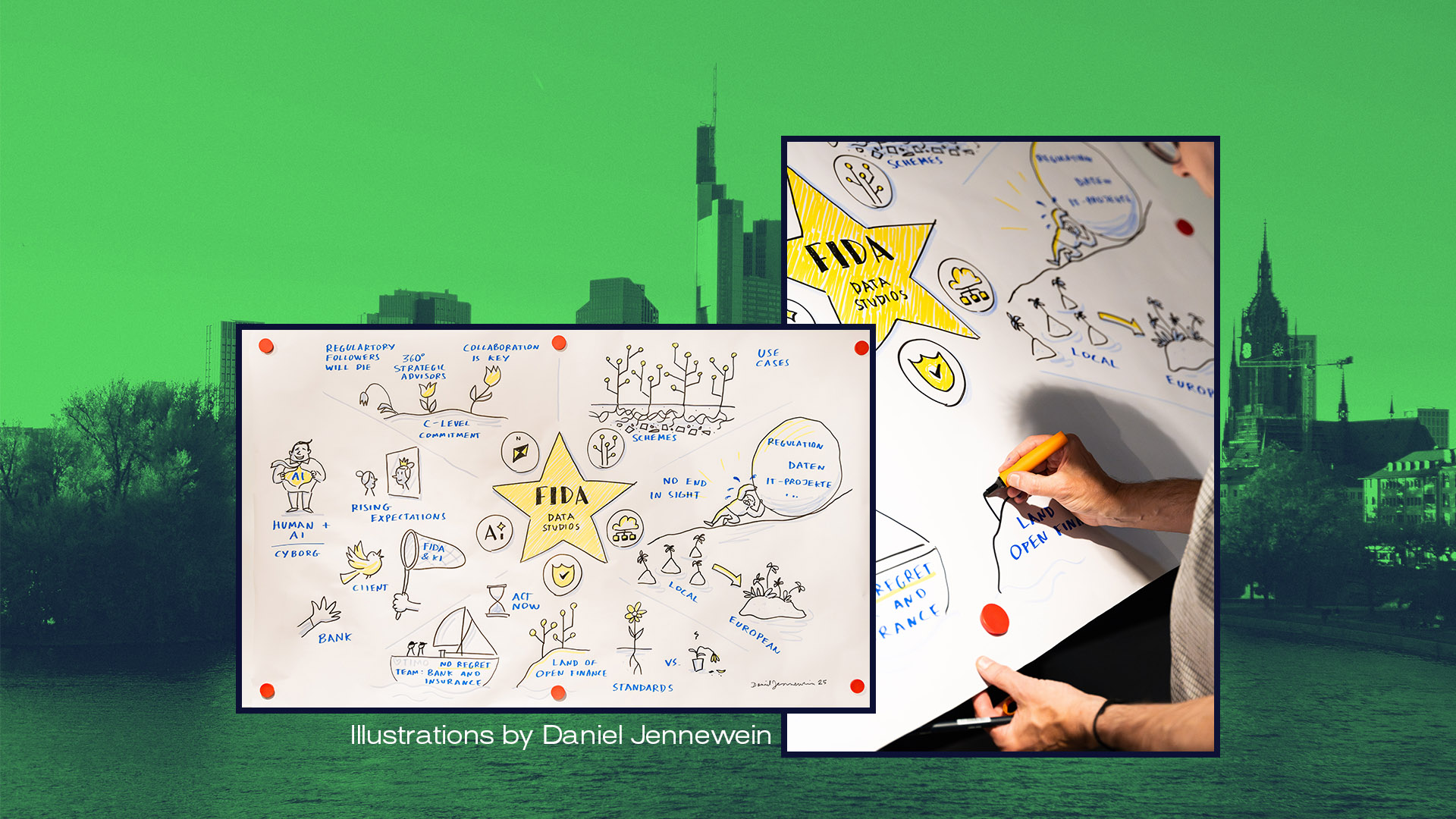

Rik Coeckelbergs (Founder and CEO, The Banking Scene) recently published a blogpost following his visit to Frankfurt’s FiDA Data Studio, organized by Deutsche Bank and TechQuartier. Held in parallel with SIBOS 2025, the workshop took place on September 29th, with our CCO Anne-Sophie Morvan also in attendance. She was later interviewed by The Banking Scene to share her takeaways from the event as well as her insights on FiDA.

Key takeaways from the FiDA Data Studio

Anne-Sophie Morvan confirmed that the event was extremely interesting, with Deutsche Bank together with TechQuartier regularly organizing such workshops around FiDA. “It shows a real strategy from Deutsche Bank regarding APIs and the opening of certain data and products”, she said, “the whole community and all stakeholders attended and exchanged: consulting firms, representatives of other large banks, professors, etc.”

Anne-Sophie Morvan noted a willingness to collaborate among participants, and create together. Even though this regulatory framework was pushed back several times, there is clear traction and great interest from certain industry players who see FiDA as a strategic project.

LUXHUB is closely following the initiatives of Deutsche Bank and other financial institutions that have decided to turn their Open Banking Platform or API platform into a real product. This represents a new channel to distribute their products or make accessible certain data. Anne-Sophie Morvan and the LUXHUB Team continue to monitor developments carefully, paying attention to the different strategies and directions taken by these players. “We are also trying to raise awareness on the overall Open Finance concept, and promote it locally”, she underlines.

An increasing FiDA appetite in Luxembourg?

The experts then discussed the interest for Open Finance in Luxembourg. According to the LUXHUB CCO, “we need to demonstrate and promote use cases that can bring real value to the customers, that can bring new revenues to the financial institutions or that can create more stickiness with the customer base”.

However, she recommends not focusing on FiDA as a regulation, but rather on Open Finance and its different opportunities. “Some banks are very progressive on this topic, Deutsche Bank for instance. In Luxembourg, financial institutions tend to be less negative than in other countries where some industry leaders have made bold statements, explaining that ‘nobody is using Open Banking’… which is simply wrong,” highlighted Anne-Sophie Morvan.

As explained by the LUXHUB CCO, in Luxembourg, banks are more generally open to it, and discussions are going on, especially on what Open Finance can bring. “We’ve noticed that they do not necessarily talk about “FiDA” as it is seen as another compliance topic, and rather prefer using the term ‘Open Finance’”, she adds, “that is the reason we try to push Open Finance use cases, focusing on opportunities rather than compliance”.

Illustrations by Daniel Jennewein