A recap of the latest VOP User Group workshop

The fifth session of our Verification of Payee user group took place on July 7th. The workshop focused on the latest updates related to the VOP Scheme rollout, on the evolution of the Payee Verification Platform solution, and also on the communication around VOP deployment.

EPC VOP Scheme updates

The LUXHUB experts first discussed the VOP Scheme adherence process, highlighting that “for PSPs that completed their registration during Wave 1 or 2, the access to the EDS testing platform was sent by the end of June”. So far, 2,507 participants have registered with the EPC, which represents 70,6% of PSPs in the SCT Scheme. And in Luxembourg, 40 institutions have already registered, with a similar percentage.

Regarding the onboarding in the EDS, and especially the standard process (contrary to the simplified one where LUXHUB receives directly access to the EDS platform on Client’s behalf), PSPs need to:

- Create a SWIFT account with the email address,

- Map the newly created SWIFT account with the entity BIC code (this mapping must be accepted by a SWIFT administrator of the entity),

- Delegate the EDS management to their dedicated RVM, i.e. LUXHUB

The LUXHUB team then focused on the ART (API Reference Toolbox) pilot testing phase and confirmed that LUXHUB, acting as the RVM, successfully passed the certification step. Consequently, VOP Scheme Participants relying on LUXHUB have their EPC VOP Scheme APIs automatically certified through LUXHUB’s certification.

The Payee Verification Platform solution

The LUXHUB solution with regards to VOP is composed of two distinct services, namely VOP Service Provision and VOP Unified Access. The development teams are on track, and Clients are currently being onboarded to ensure their readiness ahead of the October 5th deadline.

Moreover, a VOP Portal is already available, as an option, for LUXHUB Clients (see below). It contains three main features, destined to different profiles:

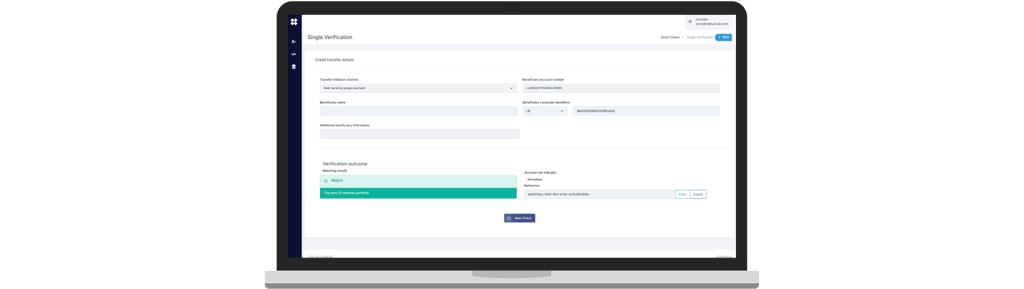

- VOP query: the ability to make direct VOP checks through GUI (Graphical User Interface – single and bulk), and the possibility to check past checks results.

- VOP usage reporting: detailed reports for past periods of time as well as aggregated KPI dashboards for incoming and outgoing VOP requests (number, average, request time, etc.), and access list to all VOP scheme participants with services’ details.

- Accounts data provision monitoring: possibility to monitor the activity of data retrieval to respond to incoming VOP requests whether they use regular file updates or a dedicated API.

Want to learn more about the features and benefits of the Payee Verification Platform?

Informing the general public

Communication being key for the successful deployment of VOP, various efforts have been and are going to be deployed to ensure that the customers are appropriately informed of the changes to come. Recently, the ABBL (the Luxembourg Banker’s Association) launched its communication campaign destined to the actual users of the upcoming VOP service. Next to this, several banks started communication campaigns and this will intensify in the months to come.

As explained by the ABBL, both payers and beneficiaries have a role to play in ensuring a smooth implementation of VOP. Here is how they can prepare.

As the payer:

- use the exact account name shown on the RIB (bank account details),

- if unavailable, refer to the name next to the IBAN on the invoice or payment request,

- update saved beneficiary names in your payment system now to avoid future issues.

As as the beneficiary:

- ensure your invoices and payment requests clearly indicate the official name linked to your account,

- avoid abbreviations, acronyms, or trade names that do not match your official account name,

- share your official RIB with customers whenever possible.