Navigating the VoP obligation: the specific case of PIs & EMIs (Part I)

On December 13th, the Payments Association EU organized a special session of its Regulatory Working Group with a focus on the Verification of Payee (VoP) obligation and more specifically on how it will impact Payment Institutions and E-Money Institutions. With LUXHUB as co-organizer of the event, Anne-Sophie Morvan and Ramzi Dziri shared their expertise on the topic, as the deadline is approaching for Payment Service Providers.

The webinar started with Thibault de Barsy (Vice-Chairman and General Manager, The Payments Association EU) welcoming the 60+ participants to this special edition. Anne-Sophie Morvan (Chief Commercial Officer, LUXHUB) and Ramzi Dziri (Head of Product, LUXHUB) then took the digital stage to dive into the VoP topic, discuss its implications for PSPs, and then focus on the specific case of PIs and EMIs.

The VoP concept

The experts first went over the general concept of the Verification of Payee obligation, highlighting the main implications for PSPs and their users. Several key resources have been released since the entry into force of IPR, providing PSPs with more accurate and detailed information, notably in terms of technical specifications (for more details, see the DG FISMA Q&As on IPR implementation, EPC VOP Scheme Rulebook, VOP Scheme Inter-PSP API Specifications and API Security Framework documents).

Anne-Sophie Morvan then explained: “since it precedes the payment authorization, the concrete result of the VoP service (matching result) is a rather critical information. It could also create potential friction for the credit transfer experience. Moreover, it could lead to financial consequences for some individuals and small businesses”. These are the reasons why VoP has rapidly become a strategic project for most PSPs. And the stakes are high for PSPs: a shift of liability and potential sanctions in case of non-compliance to IPR.

VoP timeline & scope

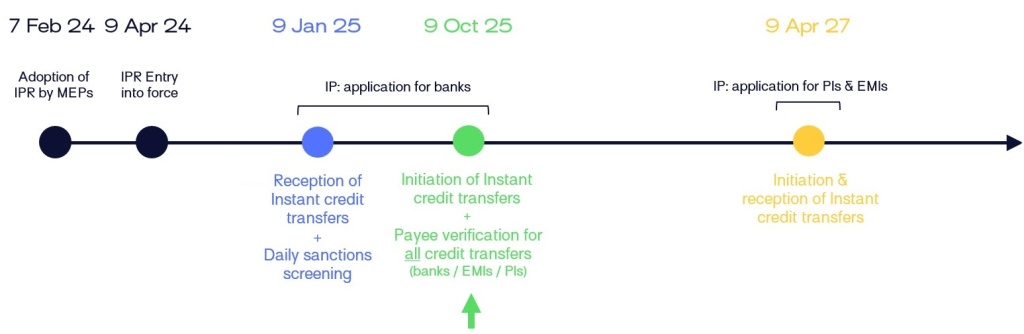

After sharing the timeline below, the experts highlighted that the first deadlines of the IPR were approaching. The VoP deadline has been set to October 9th, 2025, for all PSPs (banks, PIs and EMIs) in EURO Member States.

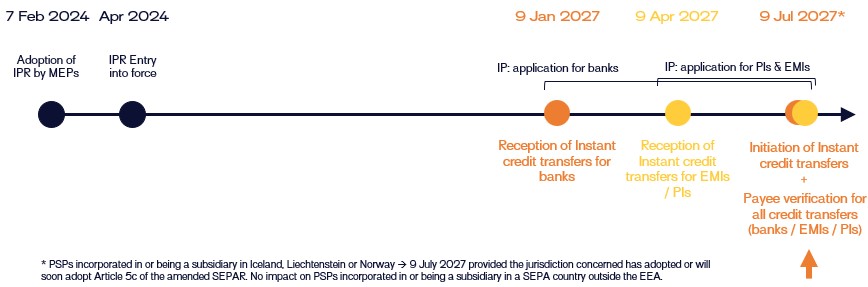

Moreover, some differences apply for non-EURO Member States. For instance, banks will have to be able to receive instant credit transfers by January 9, 2027, and EMIs and PIs will have to do it by April 9, 2027. Then, the second step for these PIs and EMIs has been set to July 9, 2027: initiation of instant credit transfers, as well as the payee verification matching service.

Concerning the scope of VoP, any PSP that offers SEPA credit transfers or SEPA instant credit transfers in euros is required to participate in the VoP scheme. This includes all banks, payment institutions and electronic money institutions, but several exceptions exist. Anne-Sophie added: “Even if a PI or EMI does not have direct access to payment systems, they still have to offer VoP services to their customers”.

The VoP scheme applies to Account-Servicing PSPs (as both Requesting PSPs and Responding PSPs) and Non-Account-Servicing PSPs (as Requesting PSPs only). Yet, there are several exclusions from the VoP scope:

→ Credit transfers done through LVPS (Large Value Payment System)

→ Credit transfers to/from non-EU/EEA PSPs

→ Transactions involving accounts not qualifying as payment accounts under PSD2

→ Money Remittance transactions

→ Non-Electronic payment orders (e.g. paper-based payments) in payer’s absence

→ In case of opt-out by the PSU under specific conditions:

- for a non-consumer PSU (including microenterprises)

- in the context of a bulk payment

- opt-in should be later available to the PSU

Want to become a member of the Payments Association EU? Get in touch with them.