A Payee Verification Platform to enable secure instant payments?

Open Finance pioneer LUXHUB is once again at the forefront of innovation. The Fintech based in Luxembourg is an Payee Verification Platform to help credit institutions comply with the EU regulation on Instant Payment. And in particular, the needs for PSPs to enable the instant match – or no match – between the payment account identifier (IBAN) and the account holder’s name.

The platform will enable the instant match between account identifier and account holder name in the context of the upcoming EU regulation on Instant Payments.

With this new solution, LUXHUB is anticipating the upcoming Instant Payment regulation in the European Union, and more specifically article 5c of the, published last October. This future piece of legislation establishes an obligation for credit institutions (among other PSPs) offering the service of sending of Euro Instant Payments (..) “to provide their PSUs (Payment Service Users) with a service checking that the payee’s IBAN matches the payee’s name and notifying the PSU of any detected discrepancy”.

The European Commission has been a key advocate for the development of instant payments in Europe, hoping to “make in the new normal”, as stated several times by commissioner McGuinness over the last year. The proposal aims at ensuring that instant payments are affordable, secure, and processed without friction across the European Union.

Today, there is clear evidence that fast payments and digital channels are leading to increasing payment frauds. For instance, it accounted for 658 Mio€ in fraud losses in 2021, and a 74% increase in app scams, from one year to another. In addition, misdirected transfers pose important trust issues for online banking users. According to a recent survey, 94% of users would feel more secure if their banks checked IBAN and beneficiary name and were to warn them in case of inconsistencies.

In this respect, LUXHUB is announcing the launch of its Payee Verification Platform in the weeks to come, duplicating the mutualized model of its recognized PSD2 XS2A solution. Today, this recognized solution counts more than 40 different clients in several European countries and was developed in the first place to accommodate the (PSD2 compliance) needs of LUXHUB’s four shareholders (BGL BNP Paribas, Spuerkeess, POST and Banque Raiffeisen).

One platform, two facets that benefit banks as well as private or public companies

This new platform and its related services will consist in federating banks to enable real-time name and account details checking for banks, public and private corporates. As underlined by Ramzi Dziri, Head of Product at LUXHUB, “leveraging a federated solution and taking an active part in building it makes a lot of sense for ‘smaller’ markets, where mutualization is all the more effective in terms of cost and results”.

On the one hand, LUXHUB aims at bringing as many banks as possible on board. “At first, this solution called “Confirmation of Payee” is destined to financial institutions, including banks, payment institutions and Fintechs who need to comply with the upcoming regulatory obligation, as provider of the account receiving the payment, by exposing an IBAN-name check interface to other PSPs. It also aims to protect their users and reduce their internal costs related to fraud and misdirected payments”, adds Ramzi Dziri. A single centralized/aggregated solution is all about:

- Allowing banks to comply to the future European regulation for the initiation of instant credit transfers

- Mutualized expertise, development and setup efforts, and costs

- Approach based on collecting data required for the checks to ensure short responses times and very high availability of the service (critical to instant payments)

- Data storage in a secured, encrypted and siloed manner

- Easy to implement and maintain process account lists import with built-in validation and based on existing regulatory reporting

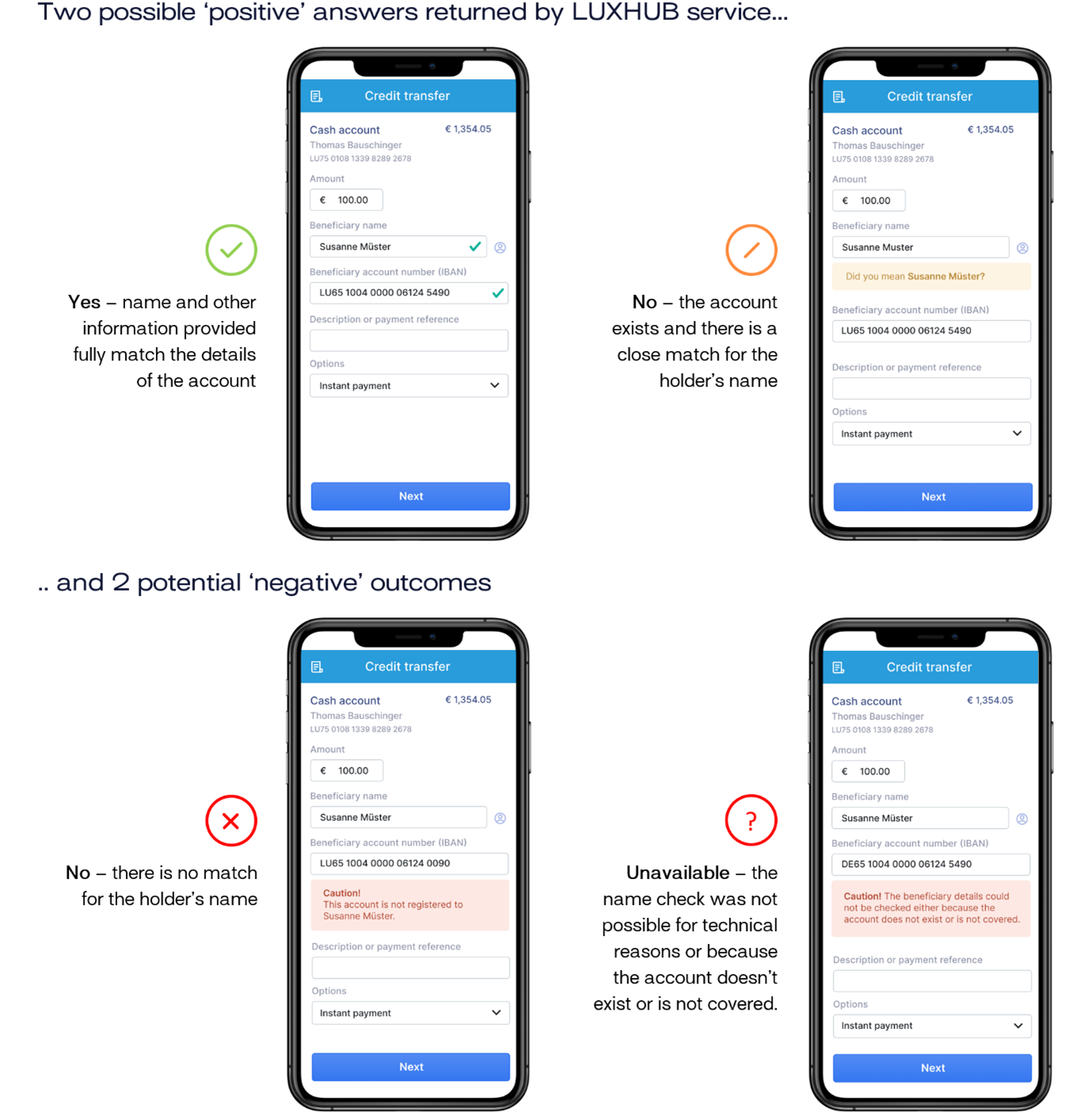

On the other hand, the other side of the coin which we call “Account Check” will enable PSPs to make sure that payments initiated by their customers are received by the rightful recipients, all over the European Union. In this respect, Account Check also allows banks to comply to the future European regulation for the initiation of instant credit transfers, but this time as the PSP initiating the payment for their account holders. The solution has several advantages:

- A single interface to check any relevant recipient account (LU or outside)

- Powerful name matching algorithm developed specifically for bank account naming specificities

- Fast response time

- Monetization potential, in the future with private and public, non-regulated, organizations

Going one step further in the near future

About this last point, the solution could evolve to benefit public and private organizations who would like to make sure that their payouts are received by the rightful recipients (tax authorities, public health insurers, private insurers, employment agencies, NGOs) or that their outgoing payments are reaching their suppliers (corporates and SMEs). One can think of several use-cases, revolving around new debtors/creditors onboarding and acceptance, existing debtors/creditors maintenance, payment initiation, as well as monitoring and investigation of payment fraud cases. For instance:

- Creation of a new beneficiary in e-banking portal

- Annual validation by an insurer in a CRM system of bank accounts validity on direct debit mandates

- Settlement with an A2A payment of a request-to-pay

- Verification of an account’s ownership when a transaction is flagged as suspicious in an internal fraud or AML monitoring tool

* Proposal for a Regulation of the European Parliament and of the Council amending Regulations (EU) No 260/2012 and (EU) 2021/1230 as regards instant credit transfers in euro, 26.10.2022.