IBAN-Name check: LUXHUB labeled as a “prominent player” is INNOPAY’s latest report

INNOPAY, the leading consultancy firm specialized in the fields of payments, just released a blogpost focusing on the need for PSPs to perform IBAN-name checks in the scope of the upcoming European legislation on Instant Payments (SCT Inst). The experts describe the three scenarios they envisage for the development of such solutions in the SEPA era, and notably mention LUXHUB’s new Account Verification Platform.

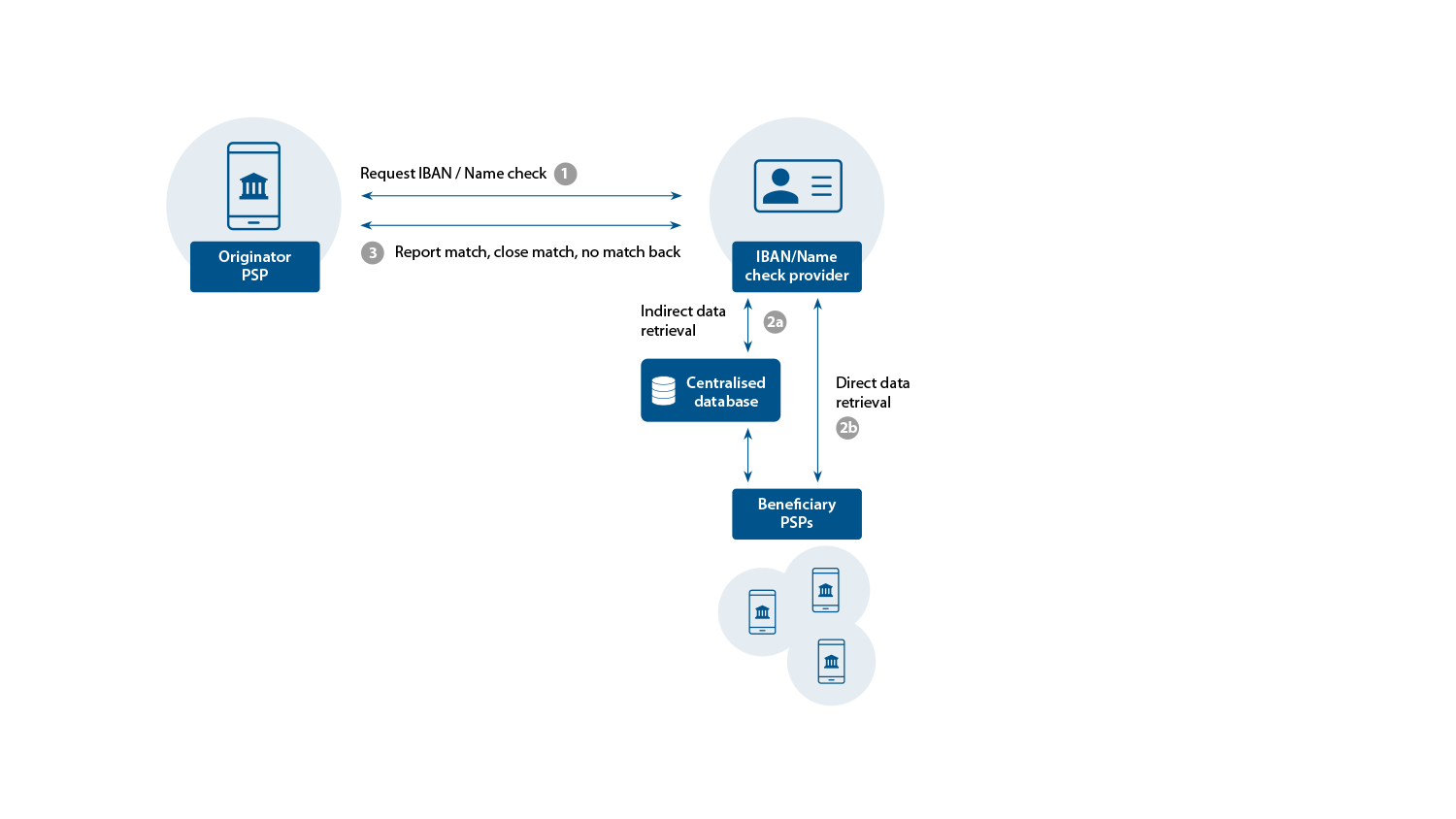

As explained in the very first lines of the article, “the IBAN/Name check, also known as Confirmation of Payee (CoP), is a relatively new functionality in the PSP’s toolbox”. The solution acts as a connector between the originator PSPs (that is about to transfer the money) and the beneficiary PSP. It then enables the validation, or not, between the beneficiary’s name and IBAN. It can either be a full match, a close match or no match. This new functionality will therefore help reduce the number of payment errors as well as authorized push payment fraud. Moreover, it will drastically increase trust for both payer and payee.

The following figure (© INNOPAY) perfectly illustrates the IBAN-name check flow.

The INNOPAY experts underline that there are two types of commercial providers in the IBAN-name check space. One of them being web/app-integrated solutions for banks and other corporations that leverage such a solution in their workflows. And LUXHUB, with its Account Verification Platform solution is mentioned.

Verified – and safe – transactions

In this respect, Account Verification Platform is destined to PSPs that aim at protecting their users and reduce their internal costs related to fraud and misdirected payments. Such a mutualized solution, for banks, means:

- reduced implementation costs (mutualization of the connectivity and matching algorithm)

- lower usage fees (lower intra-participants fee)

- and more importantly a higher value for external clients and thus monetization potential.

On the other hand, the platform will also benefit other types of companies, as explained earlier by INNOPAY. It will enable several use cases and notably:

- the creation of a new beneficiary in e-banking portal

- the annual validation by an insurer in a CRM system of bank accounts validity on direct debit mandates

- the settlement with an A2A payment of a request-to-pay

- the verification of an account’s ownership when a transaction is flagged as suspicious in an internal fraud or AML monitoring tool

READ THE FULL ARTICLE ON INNOPAY.COM

Photo by John Schnobrich on Unsplash